Compare cheap car insurance

✔ Compare cheap car insurance quotes

✔ Over 110 insurance providers

✔ Get a quote in minutes

✔ Save up to £504*

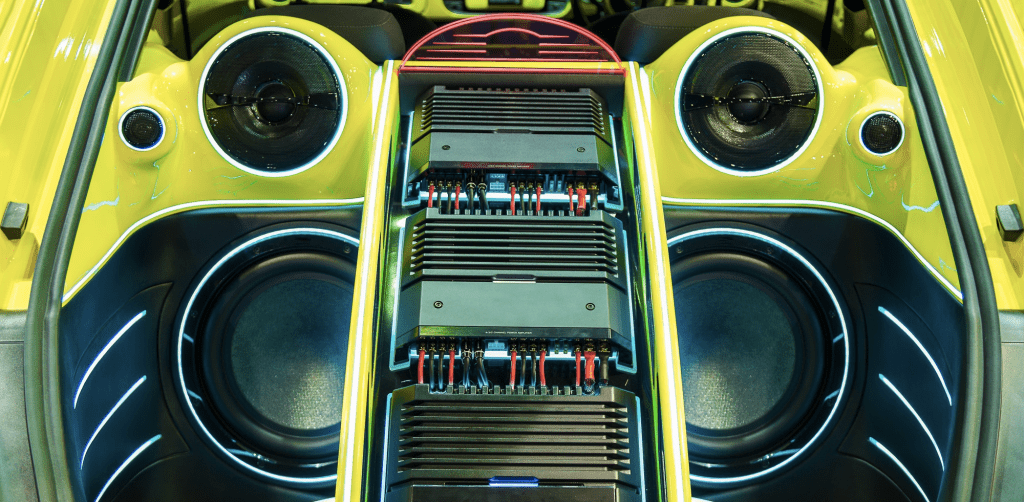

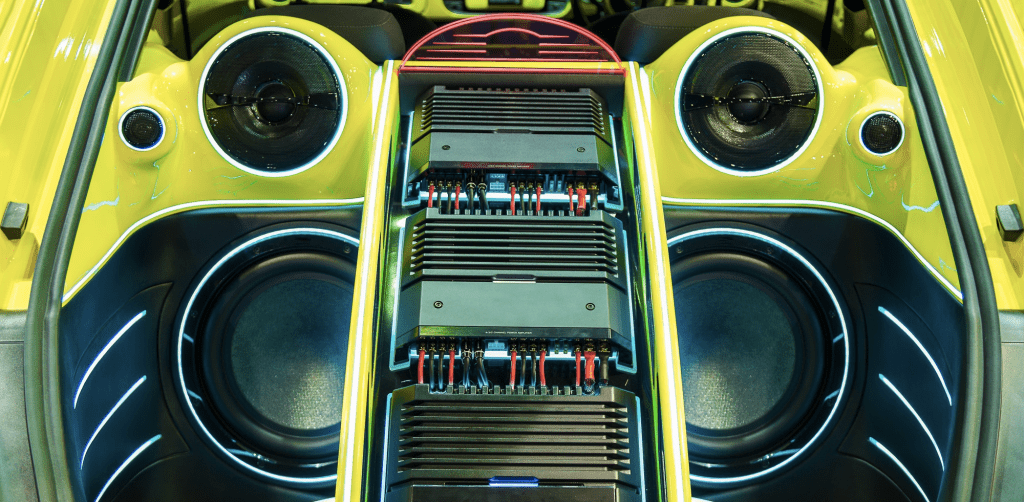

If you’re passionate about music and considering upgrading your car’s sound system, it’s important to be aware that this could have an impact on your car insurance premium. Upgrading from the standard factory-fitted audio system can increase the value of your vehicle and potentially make it more attractive to thieves.

- Will my sound system affect my car insurance?

- Why do modifications affect my car insurance?

- Will my new stereo and sound equipment invalidate my car insurance?

- How much more will I have to pay?

- How much is my sound equipment insured for?

- How can I reduce my car insurance premium?

Insurance companies take into account the value of your car and any modifications when determining your premium. Therefore, a higher-value audio system may result in an increased insurance cost.

Will my sound system affect my car insurance?

Possibly. Installing a high-end sound system in your car can increase the risk of theft and vandalism, which may have an impact on your car insurance premium.

Insurance companies take into account the value of your vehicle and any modifications when calculating your premium. A high-value sound system can potentially raise the overall value of your car, leading to a higher insurance cost.

To ensure your sound system is adequately protected and minimise any potential issues with your insurance, consider the following:

Inform your insurance provider: It’s important to notify your insurance company about any modifications or additions to your vehicle, including the installation of a sound system. Failing to disclose this information could result in a denied claim or even the cancellation of your policy.

Additional cover: Consider adding specific cover for your sound system, such as comprehensive or additional equipment cover. This can provide protection against theft, damage, or other covered incidents related to your sound system.

Enhanced security measures: Installing security features such as an alarm, immobiliser, or tracking device can help reduce the risk of theft and may be recognised by insurance companies as a safety measure. This could potentially lead to lower insurance premiums.

Keep records and receipts: Maintain records and receipts for the purchase and installation of your sound system. This documentation can be useful in the event of a claim or if you need to prove the value of your modifications.

It’s important to note that insurance companies have different policies and criteria regarding modifications, so it’s best to contact your insurance provider directly to discuss how your sound system may affect your premium and explore available cover options.

How much can you save on your car insurance?

Why do modifications affect my car insurance?

Modifications can have an impact on your car insurance because they alter the original specifications of your vehicle. Insurance companies assess the risk associated with insuring a modified car differently than a standard, unmodified vehicle. Here’s why modifications can affect your car insurance:

Increased risk of theft: Certain modifications, such as aftermarket sound systems, flashy rims, or body kit modifications, can make your car more attractive to thieves. This increased desirability raises the risk of theft, resulting in higher insurance premiums.

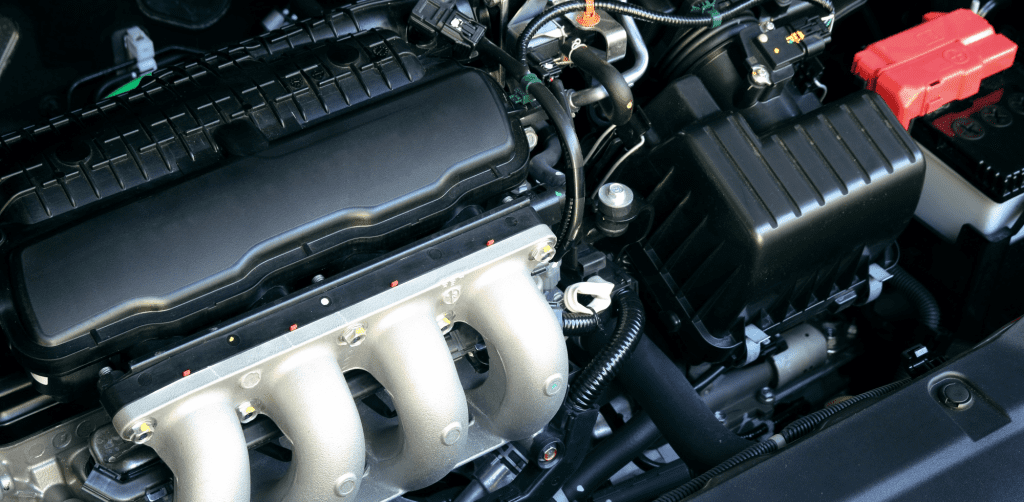

Higher performance and increased accident risk: Modifications that enhance the power or performance of your vehicle, such as engine modifications or suspension upgrades, can increase the risk of accidents. These modifications may make your car more challenging to handle or potentially lead to higher speeds, increasing the likelihood of an accident occurring.

Cost of repairs and replacement: Modifications that increase the value of your vehicle, such as cosmetic changes or engine enhancements, can raise the cost of repairs or replacement in the event of an accident. Insurance companies consider the increased financial risk associated with repairing or replacing modified parts when calculating premiums.

Limited availability of cover: Some modifications may be considered high-risk or may require specialised cover. Insurance providers may have restrictions or exclusions for certain modifications, making it more challenging to find suitable cover or resulting in higher premiums.

It’s essential to inform your insurance provider about any modifications made to your vehicle. Failing to disclose modifications can result in your policy being voided or a denied claim.

Additionally, consider seeking cover that specifically addresses your modified vehicle’s unique needs to ensure adequate protection.

Every insurance company has its own policies regarding modifications, so it’s crucial to discuss your specific situation with your insurance provider. They can provide you with the most accurate information about how modifications will affect your insurance premium and guide you through available cover options.

How much can you save on your car insurance?

Will my new stereo and sound equipment invalidate my car insurance?

Simply installing a new stereo and sound system in your car won’t automatically invalidate your car insurance policy. However, it is crucial to inform your insurance provider about any modifications or additions you make to your vehicle, including the installation of a new stereo system.

Failing to disclose modifications to your car could potentially invalidate your insurance cover. Insurance companies require accurate and up-to-date information about your vehicle to assess the risk and determine appropriate cover and premiums. By not disclosing modifications, you run the risk of having a claim denied or your policy being rendered void.

When you invest in new stereo and sound equipment, it’s advisable to contact your insurance provider and inform them about the modifications. They will be able to assess how the new equipment impacts the risk profile of your vehicle and advise you on any necessary adjustments to your cover or premium.

Keep in mind that modifications to your car, including the addition of audio equipment, can have varying effects on insurance premiums. Factors such as the value of the equipment, the installation method, and the overall impact on the vehicle’s performance and security may be taken into consideration by the insurance provider.

By proactively discussing the modifications with your insurance provider, you can ensure that your cover remains valid and appropriate for your modified vehicle.

How much can you save on your car insurance?

How much more will I have to pay?

The impact on your car insurance premium will depend on the extent and value of the modifications you make, such as installing a new sound system.

Minor upgrades may not have a significant effect on your premium, but if you opt for high-end modifications or make extensive changes to your car’s interior, there is a possibility of an increase in your insurance costs.

It’s crucial to inform your insurance provider about any modifications you make to your vehicle to ensure proper cover. Not all insurance providers offer cover for added equipment or provide sufficient cover for its replacement in case of damage or theft.

Discussing the modifications with your provider will help you understand the potential impact on your policy and whether any adjustments or additional cover are needed.

Keep in mind that some insurance policies may have specific exclusions or limitations when it comes to modifications. Reviewing the terms and conditions of your policy is important to understand the details and ensure that you have appropriate cover for your modified vehicle.

If your current insurance provider does not offer adequate cover or charges a significant increase in premiums, it may be worthwhile to explore other insurance options. Shopping around and comparing car insurance quotes from different insurers can help you find the best cover at a competitive price.

By being transparent with your insurance provider, understanding the potential impact of modifications on your premium, and exploring different cover options, you can make informed decisions about modifying your car and securing the appropriate insurance cover.

How much can you save on your car insurance?

How much is my sound equipment insured for?

Insurance providers typically set limits on cover for sound equipment, such as audio systems, sat navs, and dash cams. These limits can be based on a fixed financial amount or a percentage of your car’s value, depending on which option is lower.

To ensure you understand your cover, it’s important to carefully review the terms and conditions of your insurance policy. Some insurers may offer unlimited cover but only for standard factory-fitted systems, while any aftermarket or upgraded equipment may have a capped cover amount.

By being familiar with your policy’s details, you can determine the extent of cover for your sound equipment and evaluate whether it meets your needs. If the cover is insufficient, you may want to explore alternative insurance options or consider additional cover specifically designed to protect your audio equipment.

To ensure you have the appropriate cover for your sound equipment, it’s advisable to contact your insurance provider directly. They can provide specific information based on your circumstances and help you understand your cover options.

How much can you save on your car insurance?

Compare quotes

Shop around and compare car insurance quotes from multiple providers to ensure you’re getting the best deal. Different insurers may offer varying rates based on factors such as your age, driving history, and the type of car you own.

Increase your voluntary excess

Consider increasing your voluntary excess, which is the amount you’re willing to contribute towards making a claim. A higher excess can lead to lower premiums, but make sure you can afford to pay it in the event of an accident.

Improve vehicle security

Installing approved security devices such as alarms, immobilisers, or tracking systems can reduce the risk of theft and potentially lower your insurance premium. Park your car in a secure location, such as a locked garage or well-lit area, to further enhance its security.

Build a no-claims discount

Maintaining a claim-free record over time can earn you a no-claims discount. The longer you go without making a claim, the greater the discount you can accumulate. This can significantly lower your premium.

Drive safely

Avoid accidents and traffic violations as they can negatively impact your insurance premium. Safe driving habits and a clean driving record demonstrate to insurers that you’re a low-risk driver, which can result in lower premiums.

Consider your cover options

Evaluate the cover options you truly need. While it’s essential to have adequate protection, you may be able to save money by opting for a lower level of cover or excluding certain optional extras that you don’t require.

Pay annually

If possible, pay your car insurance premium in one lump sum annually instead of monthly installments. Insurers often charge interest or administration fees for monthly payments, so paying upfront can save you money in the long run.

Remember, it’s important to review your policy and discuss any changes or discounts with your insurance provider to ensure you’re getting the best possible rate based on your individual circumstances.