Compare European breakdown cover

✔ Compare cheap European breakdown cover

✔ Trusted breakdown cover providers

✔ Get a quote in minutes

✔ Peace of mind

Are you planning a trip to Europe by car? Don’t forget to get European breakdown cover which provides roadside assistance and vehicle recovery services in case of mechanical issues during your travels. Discover the importance of this cover and compare the options available for your trip.

- What is European breakdown cover?

- What does European breakdown cover include?

- Why do I need European breakdown cover?

- What level of European breakdown cover do I need?

- Which countries will I be covered in?

- What is excluded from European breakdown cover?

- What you need to drive in Europe checklist

- What else do I need to take with me when driving in Europe?

- How much does European breakdown cover cost?

- What do I need to get a quote?

- Frequently asked questions

What is European breakdown cover?

European breakdown cover is a service that provides roadside assistance and recovery for drivers while travelling in Europe. This cover ensures that you will receive help in case of a mechanical issue with your vehicle while on a driving holiday.

In addition to the benefits of roadside assistance and vehicle recovery, European breakdown cover usually comes with an English-speaking helpline that operates 24/7 to assist you in navigating any language barriers that may arise during your trip.

If the issue with your car cannot be resolved on-site, European breakdown cover can also take care of the expenses of getting you, your vehicle, and your passengers back home safely.

It’s important to note that this type of cover is not typically included as a standard feature of car insurance policies, so if you are planning on driving in mainland Europe, you may want to consider adding it as an optional add-on or taking out a standalone breakdown cover policy.

It’s also worth noting that the specific terms and cover of European breakdown cover can vary between providers, so it’s important to research and compare different options to ensure that you find a policy that meets your needs and budget.

How much can you save on European breakdown cover?

What does European breakdown cover include?

European breakdown cover provides a range of benefits to ensure that you have support and assistance in the event of a breakdown while driving in Europe. Here are the details of some of the common inclusions in a typical policy:

- Home start: This covers you in case your car breaks down before you even set off on your trip. If your car fails to start or has a mechanical issue at home, a recovery vehicle will come to your aid to help you get back on the road.

- Roadside assistance: If your car breaks down during your trip, a recovery vehicle will attempt to fix your vehicle by the side of the road. If the issue cannot be resolved on-site, your vehicle will be towed to the nearest garage for repair. It is important to check any call-out limits specified in your policy, as exceeding these limits may result in additional charges.

- 24/7 assistance: This feature gives you access to support and recovery at any time, day or night, to prevent you from being stranded anywhere overnight. This means you can contact the helpline for help whenever you need it.

- Garage labour costs: This covers some or all of the costs of fixing your vehicle at a garage, depending on the specific policy. Some policies may require you to add optional parts and labour cover to your policy to receive this benefit.

- Onward travel costs: If your car breaks down and cannot be fixed on-site, this feature covers the cost of continuing your journey. Some policies may provide a replacement car while yours is being repaired, while others may reimburse you for public transport costs or even cover accommodation expenses.

- Vehicle repatriation: This feature covers some or all of the costs of returning your car to the UK if it cannot be repaired in Europe. Some policies may also cover the cost of returning you and your passengers to the UK, which is known as repatriation.

- Misfuelling: This covers damages or repairs if you accidentally put diesel in a petrol car or vice versa. This is particularly important for drivers of rental cars, who may not be familiar with the fuelling system in Europe.

- Lost keys: If you lose your keys while travelling, your policy can reimburse you for the cost of replacements.

It’s worth noting that the exact terms and cover of European breakdown cover can vary between providers and policies. Therefore, reviewing the details of any policy you are considering purchasing is important to ensure that it meets your needs and budget.

Why do I need European breakdown cover?

European breakdown cover is essential if you are planning on driving in Europe, as it provides protection and assistance in the event of a breakdown. Here are some reasons why you need this cover:

-

Cost of repairs and callouts: If your vehicle breaks down without the right cover, you will have to bear the expenses of repairs and callouts. This can be a significant financial burden, especially if you have to pay for these costs in a foreign currency. European breakdown cover helps you avoid these expenses by covering the cost of repairs and callouts.

-

Language and local knowledge barriers: If you break down in a foreign country, you may face language barriers and a lack of local knowledge, which can make it difficult to organise repairs and callouts. With European breakdown cover, you have access to an English-speaking helpline that can provide assistance and support, even in the event of a language barrier.

-

Stressful situations: Breaking down in a foreign country can be an extremely stressful situation. You may be unfamiliar with the local driving rules and regulations, which can make the experience even more challenging. European breakdown cover provides peace of mind by ensuring you have access to assistance and support when you need it.

-

Wide range of options: There are many options available for European breakdown cover from various insurance providers. You can often add this cover as an extra to your existing policy or purchase it as a standalone policy. With a wide range of options available, you can choose a policy that meets your needs and budget.

In summary, European breakdown cover is an essential requirement for anyone planning on driving in Europe. It provides protection, assistance, and peace of mind, making your driving holiday or business trip stress-free and enjoyable.

How much can you save on European breakdown cover?

What level of European breakdown cover do I need?

Single-trip European cover

If you plan on driving to Europe only once or twice a year, single-trip European breakdown cover may be a cost-effective option for you. Here are some additional details:

- Covers one-off return journey: This policy covers you for a one-off return journey to European destinations, typically for a duration of up to 90 days (or up to 180 days in some cases).

- Includes UK cover: It also includes cover for your drives both leaving and returning home in the UK.

- Cost-effective for short trips: If you only plan on taking short trips to Europe once or twice a year, buying European breakdown cover for a single trip could work out cheaper than buying an annual policy.

Annual European breakdown cover

If you plan on making multiple trips to Europe throughout the year, an annual European breakdown cover may be more suitable for your needs. Here are some additional details:

- Covers unlimited journeys: This policy covers unlimited journeys to Europe in a year, typically for a duration of up to 90 days on each trip.

- Includes UK cover: It also includes nationwide cover in the UK.

- Cost-effective for frequent trips: If you’re planning several shorter trips to Europe throughout the year, an annual policy could work out cheaper than buying separate single-trip policies.

Types of vehicles covered

European breakdown cover is available for various types of vehicles, including cars, motorbikes, motorhomes, and caravans. When choosing a policy, make sure you select the one that’s appropriate for your vehicle type.

Checking existing cover

Before buying European breakdown cover, it’s important to check if you already have breakdown cover elsewhere. Some car insurance policies or packaged bank accounts may include this cover as a benefit. Checking for existing cover can help you avoid paying for duplicate cover and save you money in the long run.

Breakdown cover providers

Find the UK's leading breakdown cover providers below.

Which countries will I be covered in?

The extent of cover across countries varies based on the breakdown insurance provider that you select.

However, most policies offer cover across approximately 44 European countries, which extends beyond the European Economic Area (EEA) member states. The countries covered may include:

- Albania

- Andorra

- Austria

- Belarus

- Belgium

- Bosnia & Herzegovina

- Bulgaria

- Croatia

- Czech Republic

- Denmark

- Estonia

- Finland

- France

- Germany

- Greece

- Hungary

- Iceland

- Ireland

- Italy

- Latvia

- Liechtenstein

- Lithuania

- Luxembourg

- Malta

- Moldova

- Monaco

- Montenegro

- Netherlands

- North Macedonia

- Norway

- Poland

- Portugal

- Romania

- Russia

- San Marino

- Serbia

- Slovakia

- Slovenia

- Spain

- Sweden

- Switzerland

- Ukraine

- United Kingdom

- Vatican City

Some providers may also cover you for:

- Azerbaijan

- Cyprus

- Georgia

- Gibraltar

- Kosovo

- Turkey

To simplify the process of selecting the appropriate level of cover, many European breakdown cover providers divide the countries they cover into specific zones.

It’s important to note that the countries included in each zone can differ among providers. Therefore, it’s essential to review the policy details before purchasing cover to ensure that you will be covered in your desired European destination, as well as the countries you will travel through to reach it and return home.

How much can you save on European breakdown cover?

What is excluded from European breakdown cover?

European breakdown cover is a valuable protection to have when driving in Europe, but it’s important to understand what is excluded from the policy. Here are some details to keep in mind:

-

Policy purchase requirements: You must purchase your European breakdown cover policy before you travel, and in some cases, it may need to be purchased up to seven days in advance of your trip to be valid. Additionally, some providers may not offer cover for vehicles over a certain age.

-

Non-emergency repairs: European breakdown cover typically does not cover non-emergency repairs. It may not cover the cost of repairs at a local garage or replacement parts unless you have added parts and labour cover to your policy.

-

Comparison checklist: When comparing European breakdown cover options, be sure to check the following to ensure adequate protection:

- Is a vehicle service required before travel?

- Does the policy cover the countries you plan to visit and the duration of your trip?

- Are there any limits on the number of callouts allowed?

- Will you receive a hire car and accommodation while your vehicle is being repaired?

- Does the policy cover towing a caravan or trailer?

- Does the policy cover driving in Europe for business purposes?

- What is the maximum amount you can claim for repairs?

- What is covered in terms of onward travel if you are unable to continue your journey as planned?

- Does the policy cover misfuelling and lost keys?

-

Pay and Claim: Many European breakdown policies operate on a Pay and Claim basis. This means that, if you need to be towed off a motorway in Europe, you will need to pay the breakdown company upfront and then claim back the cost from your breakdown provider. It’s important to check if this is the case with your policy and keep this in mind in the event of a breakdown.

What you need to drive in Europe checklist

If you’re planning a driving holiday in Europe, it’s important to ensure that you have all the necessary documents and equipment to make the trip a success. Here are some essentials to consider:

- V5C log book: If you’re driving your own car in Europe, you’ll need to take your vehicle’s V5C log book with you to prove that you’re the registered keeper of the car. If you’re taking a leased or hired vehicle, you’ll need a VE103 vehicle on-hire certificate to drive it abroad.

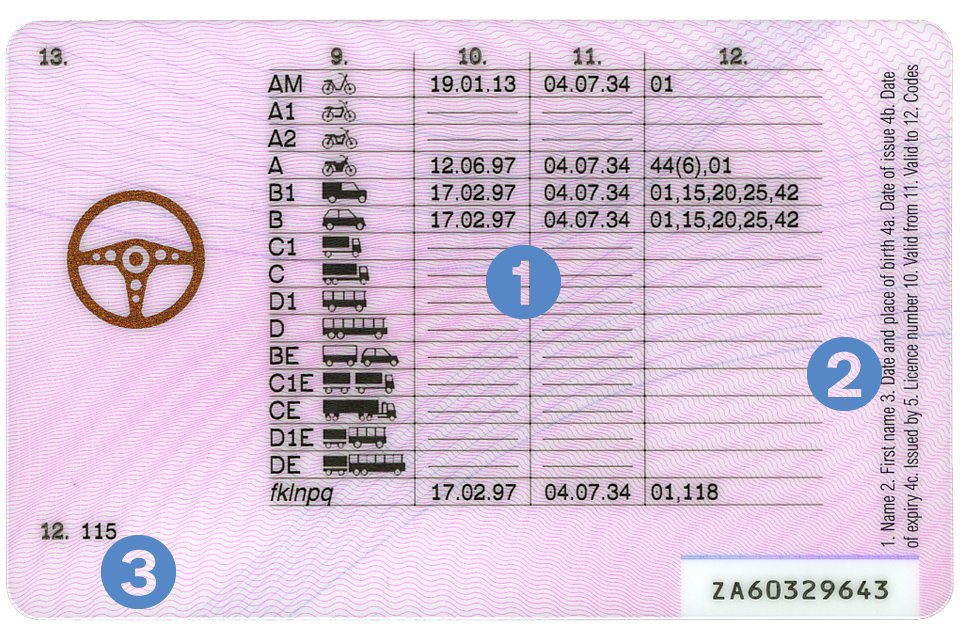

- Full UK driving licence: Your UK driving licence is valid in the EU, but you may need an International Driving Permit (IDP) if you have a non-photocard licence or you’re driving to certain European countries outside of the EU. Check the requirements for each country you plan to visit to ensure you have the necessary documentation.

- Valid UK car insurance: You won’t need a green card to drive in the EU, but you will need to have valid vehicle insurance. All UK car insurance includes third-party cover in the EU as a minimum, but it’s important to check the terms carefully to ensure that you have adequate cover for your trip.

- UK sticker: If you’re driving a UK-registered vehicle in Europe, you’ll need to display a UK sticker on the rear of the car. This applies even if your number plate has a Euro symbol, a GB symbol, or shows one of the national flags of England, Scotland, or Wales.

- European breakdown cover policy details: Having a European breakdown cover policy can provide peace of mind that help will be on the way in case of a breakdown. Make sure to carry the policy details, including the policy number and the emergency helpline number, with you at all times.

In summary, having the necessary documents and equipment when driving in Europe is crucial for a smooth and enjoyable trip. Be sure to check the requirements for each country you plan to visit and have all relevant documents and equipment with you to avoid any unexpected surprises.

What else do I need to take with me when driving in Europe?

Driving in Europe requires more than just your essential documents. It’s important to ensure that you have all the necessary equipment required by the countries you’ll be driving through. Here are some things to consider:

- Reflective jacket: Some countries require you to have a reflective jacket for each person in the vehicle. It’s a good idea to carry them even if it’s not a legal requirement.

- Warning triangle: A warning triangle is required in most European countries and can be essential in case of a breakdown or accident.

- Headlight converter stickers: These are essential if you’re driving on the right-hand side of the road, as they prevent your headlights from dazzling oncoming drivers.

- Spare bulbs: It’s important to carry spare bulbs for your car’s lights in case one goes out while you’re driving.

- First aid kit: A first aid kit is not a legal requirement in all countries, but it’s a good idea to have one on hand in case of an emergency.

- Winter equipment: If you’re driving in alpine areas, you may be required to have winter tyres and snow chains. It’s also a good idea to carry anti-freeze for your radiators and windscreen washers.

- Suitable car seats: If you’re travelling with children, make sure you have suitable car seats for their age and weight.

- Other items: While not compulsory, other items that may come in handy if you break down include a spare fuel can, engine oil and water for topping up, a torch, a fire extinguisher, a blanket, and sun cream.

Before you travel, it’s important to research the requirements of each country you’ll be driving through to ensure that you’re fully prepared and comply with local rules. This will help you avoid any unexpected fines or penalties and ensure a safe and stress-free journey.

How much does European breakdown cover cost?

The cost of European breakdown cover can vary depending on a number of factors. Here are some things to consider:

- Trip duration: The longer your trip, the higher the chance of a breakdown occurring, which can impact the cost of your policy.

- Vehicle age and condition: The age and condition of your vehicle can affect the likelihood of a breakdown occurring, which in turn can impact the cost of your policy. It’s worth noting that some providers may not offer cover for vehicles over a certain age.

- Level of cover: The cost of your policy will also depend on the level of cover you choose. Generally, the more comprehensive the cover, the more expensive the policy will be.

- Destination: The countries you plan to visit can also affect the cost of your policy. Different cover levels may include more countries than others, so it’s important to check that the policy covers your intended destination.

When comparing policies, it’s important to read the terms and conditions carefully to ensure that the policy provides the level of cover you need. Be aware of any exclusions or limitations that could impact your ability to make a claim.

You can use comparison websites to get European breakdown cover quotes, but it’s also a good idea to get quotes directly from providers to ensure that you’re getting the best deal.

What do I need to get a quote?

To get a quote for cheap European breakdown cover, you’ll need to provide some basic information. Here’s what you’ll typically need to provide:

- Trip dates: For single trip policies, you’ll need to provide the start and end dates for your trip.

- Vehicle details: You’ll need to provide details about your vehicle, including the age, registration, manufacturer, and model.

- Personal information: You’ll need to provide some personal details, such as your name and address.

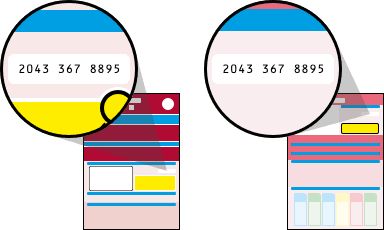

Once you’ve entered this information, you can compare quotes from multiple providers on one easy-to-read page.

The policies will be listed with the cheapest option first, along with an overview of the main benefits of each policy. It’s important to read the terms and conditions carefully before choosing a policy to ensure that it provides the level of cover you need.

How much can you save on European breakdown cover?

Frequently asked questions

The COVID-19 pandemic has had an impact on travel and European breakdown cover policies. Here’s what you need to know:

- Your European breakdown cover should still be valid, and your provider should still be able to assist you. However, it’s important to read your policy documents carefully or get in touch with your provider to confirm this before you travel.

- Some policies may have specific COVID-19-related exclusions or limitations, so it’s important to check the terms and conditions carefully.

- You should also check for any local restrictions or requirements in the country you’re travelling to. Some countries may have quarantine or testing requirements in place for travellers, so it’s important to be aware of these before you travel.

- For up-to-date travel advice on your destination, check the UK government’s latest travel advice. This will provide information on any travel restrictions or requirements, as well as general safety advice for travellers during the pandemic.

By staying informed and checking your policy and travel advice from the UK Government before you go, you can ensure that you have the appropriate European breakdown cover and are prepared for any potential issues that may arise during your trip.

Following the UK’s departure from the EU, your European breakdown cover will still be valid and offer the same level of protection as before Brexit. (unless your provider has informed you otherwise).

However, if you’re unsure, it’s important to check your policy documents or contact your provider to confirm that your cover is still valid. By taking these steps, you can ensure that you have the appropriate breakdown cover for your trip and are prepared for any potential issues that may arise.

It’s possible that European breakdown cover is already included in your existing breakdown policy, so it’s important to check the policy documents or terms and conditions to confirm.

However, keep in mind that some policies may only include European cover for very short trips and at the lowest level of cover, so it’s important to ensure that the cover meets your needs.

If European breakdown cover is not already included in your policy, you can purchase it as a standalone policy. This option allows you to choose a policy that specifically meets your needs and provides adequate cover for your trip.

By comparing policies and selecting the right level of cover for your trip, you can ensure that you’re prepared for any potential breakdowns during your travels in Europe.

Yes, if you’re looking for cover for a one-time trip, you can purchase a single-trip European breakdown cover policy. These policies can be tailored to fit your specific needs and duration of your trip, with some policies available for as little as one day.

Keep in mind that European breakdown cover typically covers all of Europe or specific zones, so it may not be possible to purchase cover for just the country you’re visiting.

By selecting a single-trip policy that meets your needs and provides adequate cover for your travels, you can have peace of mind and be prepared for any potential breakdowns during your holiday.

Whether or not your European breakdown policy covers you to drive in the UK depends on the specific policy you choose. However, in most cases, standard policies will provide cover for driving in both the UK and Europe.

It’s important to review the terms and conditions of your policy to confirm whether or not driving in the UK is included in your cover. By understanding your policy and its cover, you can ensure that you have adequate protection for your travels both in the UK and Europe.

Yes, European breakdown cover often includes a feature called ‘vehicle repatriation’, which can cover some or all of the costs of returning your car to the UK if it cannot be fixed during your travels. This means that you won’t be left stranded overseas with a broken-down vehicle.

It’s important to check the details of your policy to see if repatriation is included for both you and your passengers, as sometimes it may only cover the cost of bringing the car back to the UK. By understanding the specifics of your policy and the cover it provides, you can ensure that you’re fully protected during your travels in Europe.

When planning a trip to Europe, it’s not just breakdown cover that you need to consider. You should also check your main vehicle insurance policy to make sure you have adequate cover while driving abroad.

While your UK car insurance policy will typically provide cover within Europe, it may only include the minimum level of third-party cover.

To ensure that you have the right level of protection for you and your vehicle, it’s best to check your policy and understand any exclusions before setting off. You don’t need a Green Card to drive in most European countries, but you should carry proof of your UK insurance with you.

It’s also important to note that some insurance policies may require that your car is serviced before you travel. By checking your main vehicle insurance policy in addition to your breakdown cover, you can ensure that you’re fully prepared and protected during your European travels.

If you experience a breakdown and do not have European breakdown cover, you will need to find a recovery company and a garage to repair your vehicle, and you will have to pay for these services out of pocket.

Additionally, if your vehicle cannot be repaired and needs to be repatriated back to the UK, you will have to cover the high costs associated with that process.

It is important to note that finding assistance and arranging repairs in a foreign country can be a challenging and stressful experience, especially if you do not speak the local language or are not familiar with the local laws and customs.

This is why it is highly recommended to have European breakdown cover in place before embarking on a driving holiday in Europe.

If you have a UK car insurance policy, it will provide third-party cover to drive in EU countries as standard. However, if you want more comprehensive cover while driving in Europe, you may need to add it as an extra to your existing policy or take out a separate policy altogether.

Temporary car insurance to cover you while driving in Europe is also available. Just make sure to compare policies and cover levels to find the best option for your needs.

If you are concerned about not speaking the local language when needing help, most European breakdown policies come with a 24/7 English-speaking helpline, as well as multi-lingual operators.

These operators will assist you in organizing the help you need, so you should not have to worry if you don’t speak the local language.

European breakdown cover for motorhomes and caravans is available from some providers, but there are usually restrictions based on weight and size. The maximum weight for motorhomes is typically 3.5 tonnes, and the maximum overall dimensions are usually length 7m, height 3m, and width 2.3-2.55m. Caravans are also typically subject to weight and height restrictions.

It’s important to inform your breakdown insurance provider if you’ll be towing a caravan in Europe, as you may need to pay a towing supplement. Additionally, most companies will only recover a caravan if it’s attached to the vehicle.

If you’re a member of a caravanning club, such as The Camping and Caravanning Club, you may be eligible for dedicated motorhome and European caravan breakdown cover. These policies often have benefits such as no weight and size restrictions.

If your car cannot be fixed before your planned return, some European breakdown policies will cover the costs of getting your vehicle back to the UK. In some cases, this may also include the use of a hire car and the costs of getting you and your passengers home.

However, it is important to note that the specific cover and limits for vehicle and passenger repatriation may vary between breakdown insurance providers. Therefore, it is essential to read the policy details carefully before you buy, to make sure you have adequate cover for your needs.

European breakdown cover is highly recommended to avoid paying for repairs and callouts if your vehicle breaks down in Europe without the right cover.

It also provides peace of mind in organizing everything in a foreign country where you may not understand the local language or road rules.

You can get temporary European breakdown cover for various durations, ranging from a single day up to 90 days, or opt for an annual multi-trip cover, which provides 90 days of cover per trip, and an unlimited number of trips within a year, as long as each trip is no longer than 30 days.

Annual European breakdown cover provides up to 90 days of cover per trip for all journeys to Europe made within a year, making it a cost-effective option for those who drive to Europe frequently.