Compare cheap car insurance

✔ Compare cheap car insurance quotes

✔ Over 110 insurance providers

✔ Get a quote in minutes

✔ Save up to £504*

Cosmetic car insurance provides cover for minor damage to your vehicle, such as dents and scratches, preventing the need to claim on your standard insurance policy.

Traditional car insurance typically covers significant issues – it’s there for you if your car sustains serious damage or is stolen. But what about those annoying, yet minor, imperfections like a noticeable scratch on your vehicle’s paintwork?

Scratches and dents are common occurrences and, if left unattended, the damage can worsen. However, fixing these issues can be costly, and many individuals are reluctant to claim on their insurance for such minor damage due to the potential loss of a no claims discount and the risk of increased premiums in the future.

This is where cosmetic car insurance becomes valuable. Opting for an affordable cosmetic insurance policy ensures you’re covered for a range of minor repairs without impacting your primary insurance.

Our comprehensive guide provides all the essential information about cosmetic car cover – continue reading to determine if it’s a suitable option for you.

What is Cosmetic Car Insurance?

Understanding Cosmetic Car Insurance

Cosmetic car insurance, also known as scratch and dent insurance, is a specialised form of car insurance. Its primary focus is to cover damage specifically to your car’s paintwork or bodywork.

This type of insurance is particularly useful for minor damages, such as scratches or small dents, which don’t affect your car’s overall functionality but can detract from its appearance.

Key Features of Cosmetic Car Insurance

One of the significant benefits of this insurance is that it is typically offered as a stand-alone policy or as an add-on to your standard car insurance policy. A noteworthy advantage of cosmetic car insurance is that making a claim generally does not impact your no claims discount.

This is particularly beneficial for drivers who have amassed a significant no claims discount over the years, as it allows them to maintain these savings while still addressing minor damages to their vehicle.

How Does Cosmetic Car Insurance Work?

The Claims Process

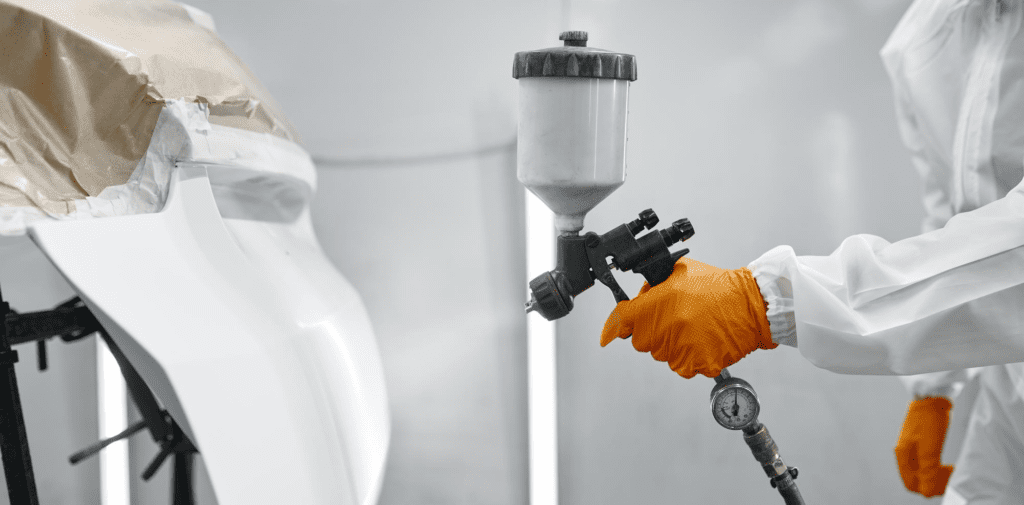

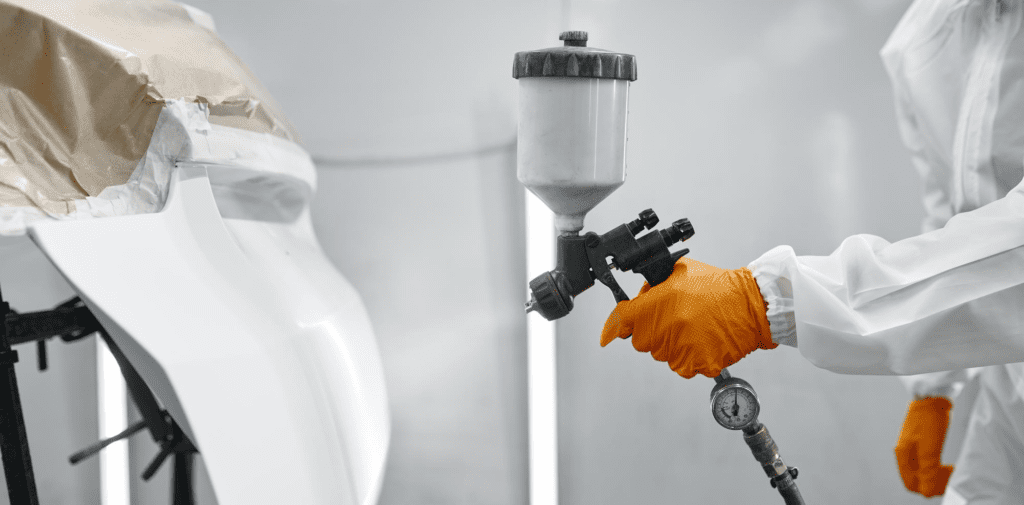

When it comes to making a claim on your cosmetic car insurance, the process can vary. You may need to take your car to a designated garage, but many policies offer the convenience of mobile repair services. This is where SMART repair technology comes into play.

SMART, standing for Small and Medium Area Repair Technology, is a method whereby minor scratches and dents can be repaired efficiently and effectively, often without the need to replace any parts.

This technology enables repairs to be carried out at your home or workplace, adding a level of convenience.

Policy Limitations

It’s important to note that, like any insurance policy, cosmetic car insurance often comes with certain limitations. These could include a cap on the number of claims you can make within a year or over the policy’s lifetime.

There might also be a limit on the total amount the policy will cover in terms of repair costs. These limitations are in place because while cosmetic car insurance is designed for minor damages, it is not intended to cover large-scale repairs or damages from serious accidents.

How much can you save on your car insurance?

Does Car Insurance Normally Cover Scratches and Dents?

Comprehensive Car Insurance and Minor Damages

When it comes to fully comprehensive car insurance, it typically includes cover for scratches and dents. However, whether it’s advisable to claim for such minor damages is another matter.

Although your policy may technically cover these issues, there are several factors to consider before making a claim.

Considerations Before Claiming

Impact on No Claims Discount and Premiums

One significant factor is the potential impact on your no claims discount. Insurers keep track of how often you make claims, and frequent claims can lead to losing this bonus.

Furthermore, after making a claim, you might find that your insurance premiums increase. As a result, a minor claim for a scratch or dent could lead to higher costs in the long term, outweighing the immediate benefits of the claim.

Excess Payments

Another crucial aspect to consider is the excess on your policy. This is the amount you’re required to pay towards any claim.

Given that cosmetic repairs, such as those for minor scratches and dents, are relatively low-cost, you might find that the excess payment is comparable to, or even exceeds, the cost of the repairs themselves.

In such cases, claiming on your insurance might not be financially prudent, as you could end up paying the majority of the repair costs out of pocket.

Alternative Solutions

Given these factors, it’s worth considering alternative solutions for minor cosmetic damage. Options such as cosmetic car insurance, or paying for repairs yourself, might be more cost-effective in the long run.

It’s always advisable to weigh the cost of the repair against the potential increase in premiums and the loss of any no claims bonus before deciding to claim on your main car insurance policy for minor scratches and dents.

How much can you save on your car insurance?

What Does Cosmetic Car Insurance Cover?

Cover of Cosmetic Car Insurance

Cosmetic car insurance is specifically designed to cover minor external damages to your car. This includes a range of superficial damages such as scuffs, scratches, dents, chips, and scrapes.

For instance, if you park your car in a public area and return to find the finish has been damaged, this type of insurance can provide cover for the repairs needed to restore your car’s appearance.

Types of Damages Covered

This insurance typically includes damages that don’t affect the functionality of the car but impact its aesthetics. Common scenarios where cosmetic car insurance is applicable include minor accidents in car parks, damages from small road debris, or the wear and tear that occurs from regular use.

What Doesn’t Cosmetic Car Insurance Cover?

Exclusions in Cosmetic Car Insurance

While cosmetic car insurance covers a range of minor damages, it has its limitations. Importantly, it does not cover damages that affect the actual functioning of your car.

This includes parts like the windscreen, headlights, and indicators. Additionally, some policies might exclude certain areas like hubcaps or bumpers.

Limitations on the Level of Damage

Insurers often have specific criteria regarding the extent of damage they will cover under a cosmetic car insurance policy. For instance, a policy may not cover a dent that is wider than approximately 30cm or deeper than 3cm.

These limitations are in place to differentiate between minor cosmetic damage and more significant bodywork damage, which would typically be covered under a standard car insurance policy.

Importance of Policy Details

It is crucial to read the policy documents thoroughly to understand the specifics of what is and isn’t covered.

The terms can vary significantly between different insurers, so understanding the details of your policy ensures that you are fully aware of the extent of cover provided for cosmetic damages to your vehicle.

How much can you save on your car insurance?

How Much Does Cosmetic Car Insurance Cost?

Factors Influencing the Cost

The cost of cosmetic car insurance is generally affordable, often not exceeding much more than £10 per month. However, the actual price of the policy can vary based on several factors:

Car Make and Model

The make and model of your car play a significant role in determining the cost of cosmetic car insurance. For instance, luxury vehicles or cars with specialised paint jobs might incur a higher insurance premium due to the potentially higher cost of repairs.

Usage and Parking Conditions

How and where you use your car also influences the cost. If your car is typically parked in a secure, private driveway, the risk of cosmetic damage may be perceived as lower compared to a car regularly parked in public areas. As a result, the insurance cost could be reduced for cars with lower risk factors.

Shopping for Cosmetic Car Insurance

As an Add-On to Standard Policies

Cosmetic car insurance is often available as an add-on to a standard car insurance policy. Utilising price comparison services can be an effective way to find policies that include scratch and dent cover.

These services allow you to compare different options and see if cosmetic cover is offered in any of the quotes you receive.

Standalone Policies and Dealership Offers

While Comparoo and similar platforms may not compare standalone cosmetic insurance policies, there are numerous specialist providers in the market that offer such policies.

Additionally, when purchasing a car from a dealership, cosmetic car insurance might be available as an extra. It’s advisable to explore these options to find a policy that best suits your needs and offers the most comprehensive cover for cosmetic damages at a reasonable price.

How much can you save on your car insurance?

Is Cosmetic Car Insurance Worth It?

Evaluating the Need for Cosmetic Car Insurance

The value of cosmetic car insurance largely depends on individual circumstances and the likelihood of using the cover. It’s a balancing act between the potential savings on repair costs and the price of the insurance itself.

Frequent Minor Repairs

If you find yourself frequently paying for minor repairs, such as touch-ups to your car’s paint job, then investing in cosmetic car insurance could be economically beneficial in the long run. This is especially true if your car is prone to cosmetic damage due to regular use or parking conditions.

Infrequent Damages

Conversely, if your car is generally well-maintained and only occasionally incurs minor scratches or dents, it might be more cost-effective to pay for these repairs out of pocket rather than investing in an insurance policy.

Advantages of Cosmetic Car Insurance

Protection of No Claims Bonus

One of the major benefits of cosmetic car insurance is that it allows you to claim for minor bodywork damage without affecting your no-claims discount on your main car insurance policy. This means that while you keep your car looking its best, you also protect yourself from potential increases in premiums due to claims.

Affordable Premiums

Another advantage is the affordability of this type of insurance. With costs potentially less than £10 per month, it can be a budget-friendly option for maintaining your vehicle’s appearance.

Disadvantages of Cosmetic Car Insurance

Policy Limitations

However, it’s important to be aware of the limitations within cosmetic car insurance policies. Many policies have restrictions on the size and type of damage they will cover. For example, they may not cover scratches or dents above a certain size.

Excess and Claim Limits

Some policies come with a significant excess, meaning you’ll need to contribute towards the cost of repairs. This can reduce the overall usefulness of the insurance.

Additionally, there might be a cap on the number of claims you can make in a year, limiting the policy’s practicality for those with frequent minor damage.

How much can you save on your car insurance?

Where Can I Find Cosmetic Car Insurance?

Finding Cosmetic Car Insurance Providers

While Comparoo specialises in standard car insurance policies and doesn’t provide scratch-and-dent insurance, there are other avenues through which you can obtain this specialised form of cover.

Car Dealerships

Often, car dealerships offer cosmetic car insurance as an optional extra when purchasing a vehicle. These policies are tailored to cover the specific needs of new car owners, focusing on minor damages that can occur in everyday use.

Specialist Brokers

Additionally, specialist brokers are a valuable resource for finding cosmetic car insurance. These brokers have expertise in this niche area and can assist in locating a policy that best fits your requirements, ensuring you get the appropriate cover for your vehicle’s cosmetic needs.

Frequently asked questions

Cosmetic car insurance is a policy that covers minor damages on the exterior of a car such as scuffs, scratches, dents, chips and scrapes. This insurance policy is useful for those who want to protect their car from any damages caused in car parks or other similar situations.

Cosmetic repair insurance is an insurance policy that covers the cost of repairing minor cosmetic damages to your vehicle, such as small dents, scratches, and scuffs.