Compare cheap car insurance

✔ Compare cheap car insurance quotes

✔ Over 110 insurance providers

✔ Get a quote in minutes

✔ Save up to £504*

If you’re curious about whether a credit check is necessary for car insurance, this guide has got you covered.

- Do Car Insurance Providers Check Credit?

- Do Insurance Quotes Affect Your Credit Score?

- Does My Credit Score Affect My Car Insurance?

- Can I Check My Credit Report Before Buying Car Insurance?

- Frequently asked questions

It explains the role of credit checks in determining your insurance premium and provides detailed insights into how this process works.

Do Car Insurance Providers Check Credit?

Initial Credit Checks for Verification

Yes, car insurance providers routinely conduct credit checks. This is a fundamental part of their assessment process. The primary aim of these checks is to verify your identity.

By accessing your credit report, insurers can confirm you are indeed who you claim to be. This step is crucial in mitigating the risk of fraud.

Credit Checks for Monthly Payments

Furthermore, how you choose to pay for your car insurance also influences the extent of the credit check. If you opt to pay your premium monthly, your insurer will perform a more comprehensive credit check.

This is because monthly payments are essentially a credit agreement, and insurers need to assess your creditworthiness.

In contrast, if you pay annually, this extensive credit check might not be necessary, as the full premium is paid upfront, eliminating the need for a credit agreement.

It’s important to note that these credit checks can have an impact on your insurance premiums.

Insurers may use your credit score as one of the factors to determine the risk of insuring you. Generally, a higher credit score could lead to more favourable premium rates, as it suggests financial stability and reliability.

Consent and Transparency

Remember, insurance companies should always seek your consent before conducting a full credit check. They are also expected to be transparent about the use of your credit information.

It’s always a good idea to check the terms and conditions or directly ask your insurer about their credit check policies.

Key Takeaway

Credit checks are a standard procedure in the car insurance industry, serving both identity verification and risk assessment purposes, especially when opting for monthly payment plans.

How much can you save on your car insurance?

Do Insurance Quotes Affect Your Credit Score?

Soft Searches for Quotes

No, obtaining insurance quotes will not impact your credit score. When you seek quotes, insurance companies conduct what is known as a soft search. This is a basic check to verify the accuracy of the details you have provided.

Crucially, this type of search is only visible to you and does not influence your credit score. It’s a standard practice in the industry to ensure information correctness.

Hard Searches for Monthly Payments

However, if you opt to pay for your car insurance every month, the scenario changes slightly. In this case, insurers typically carry out a hard search on your credit history.

This more detailed investigation will appear on your credit report and be visible to other lenders. The reason behind this is that monthly payments are essentially a credit agreement, and the insurer needs to assess your reliability in managing credit.

Impact of Hard Searches

While a hard search can leave a mark on your credit report, the effect is usually temporary. Nonetheless, multiple hard searches over a short period can be detrimental to your credit score. This could be interpreted by lenders as a sign of financial distress or an urgent need for credit.

Paying Annually vs Monthly

Paying your car insurance in one go, if financially feasible, is often advisable. This avoids the necessity of a hard credit check and any associated interest charges, making it more cost-effective in the long run.

Comparoo Quotes

As for getting a quote from Comparoo, it follows the same principle. Your credit score remains unaffected as only a soft search is conducted, which other providers cannot see.

Top Tip: Cancelling Insurance

If you decide to cancel your car insurance, especially when paying monthly, it’s vital to inform your insurer and cancel the associated Direct Debit.

Failure to do so could be mistaken for missed payments, adversely affecting your credit score. Remember, missed payments, whether intentional or accidental, can linger on your credit report for up to six years.

Key Takeaway

While insurance quotes themselves do not affect your credit score, the way you choose to pay for your insurance and the associated credit checks do have implications. It’s important to understand these nuances to make informed financial decisions.

How much can you save on your car insurance?

Does My Credit Score Affect My Car Insurance?

The Impact of Credit Score on Insurance Cost

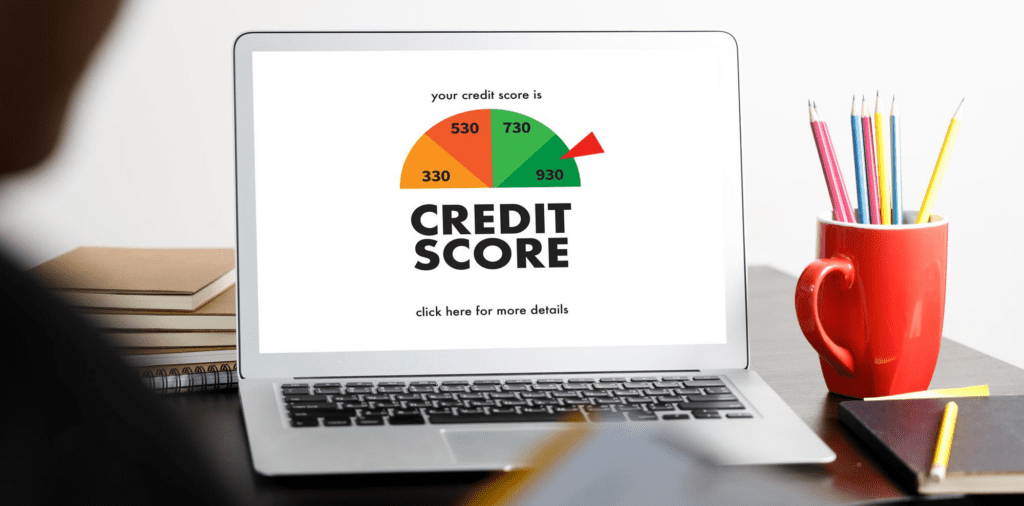

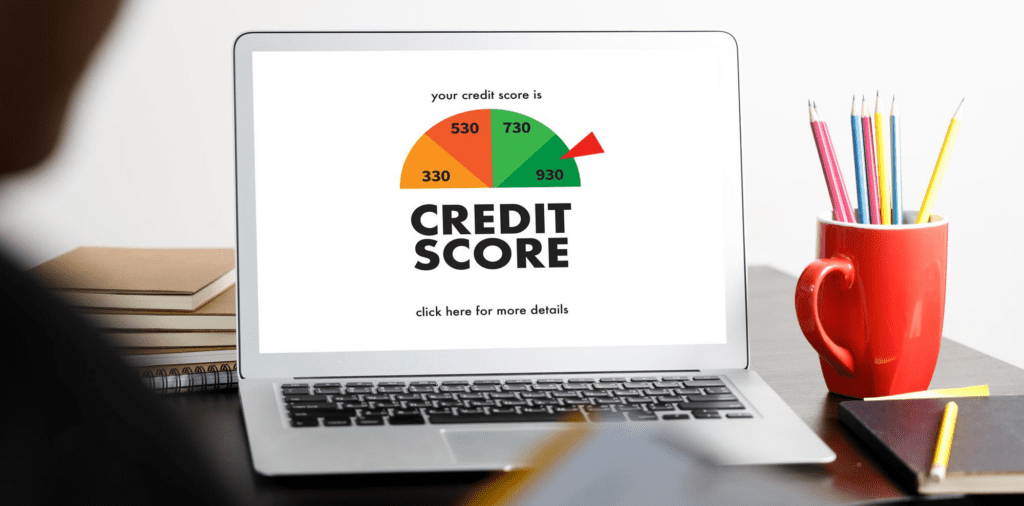

Yes, your credit score can indeed influence the cost of your car insurance. Insurance providers often view a poor credit history as an indicator of higher risk.

This perception stems from the belief that individuals with bad credit are more likely to file insurance claims. Moreover, a poor credit score can be interpreted as a lack of reliability in repaying debts, which insurers might see as a financial risk.

However, it’s important to note that your credit score is just one of several factors insurers consider. The price of your car insurance is also determined by:

- Your address: The area you live in can affect your risk profile.

- Your job: Certain professions may be deemed as higher risk.

- Your age: Younger drivers often face higher premiums.

- Your driving history: A clean driving record can lower costs.

- The make and model of your car: Some cars are more expensive to insure.

- Your no-claims discount: A history of no-claims can significantly reduce premiums.

Improving Your Credit Score

The positive aspect is that a poor credit score isn’t permanent. There are several strategies you can employ to improve your credit score over time. These include:

- Paying bills and existing loans on time.

- Reducing overall debt.

- Regularly checking your credit report for errors and correcting them.

- Not applying for new credit frequently.

Key Takeaway

While your credit score does play a role in determining car insurance costs, it’s one of many factors considered. By understanding these factors and working on improving your credit score, you can potentially reduce your insurance expenses.

How much can you save on your car insurance?

Can I Check My Credit Report Before Buying Car Insurance?

Importance of Checking Your Credit Report

Yes, you can and should check your credit report before purchasing car insurance, especially if you plan to pay for your insurance in monthly instalments.

Knowing your credit status is vital as it can affect the terms of your insurance, including the cost.

How to Check Your Credit Report

You have the option to access your credit report for free through one of the three major credit reference agencies in the UK: Experian, Equifax, or TransUnion. Each agency might have slightly different information, so it’s a good idea to check your report with more than one agency to get a comprehensive view of your credit status.

Benefits of Regular Credit Checks

Early Detection of Errors

Regularly reviewing your credit report isn’t just beneficial for car insurance purposes. It helps you spot any inaccuracies or mistakes that could negatively impact your credit score.

Timely detection of these errors allows you to rectify them before they affect your financial decisions.

Monitoring for Fraudulent Activity

Another critical aspect of keeping an eye on your credit report is the early detection of fraudulent activities.

Your credit record lists all your credit applications, and any unauthorised or fraudulent applications made in your name will be visible. This early warning system enables you to take immediate action against any identity theft or fraud.

Top Tip: Maintaining a Healthy Credit Score

Beyond checking for accuracy and fraud, regularly monitoring your credit report helps you understand how different financial behaviours affect your credit score.

This understanding can guide you in maintaining or improving your credit health, which is beneficial not just for car insurance but for any form of credit or loan you might seek in the future.

Key Takeaway

Checking your credit report is a prudent step not only before buying car insurance but also as a regular financial health check.

It ensures your credit information is accurate, safeguards against fraud, and helps you maintain a healthy credit profile.

How much can you save on your car insurance?

Frequently asked questions

Yes, it’s possible to be refused car insurance if you have a bad credit score. Some insurance providers might consider a poor credit history as a higher risk factor and therefore may not offer you insurance.

However, don’t be disheartened, as the insurance market is vast with a variety of providers. By shopping around, you have a good chance of finding an insurer who can accommodate your situation and offer you a suitable deal.

Remember, each insurance company has its own policies and criteria for assessing risk, so one refusal doesn’t mean all doors are closed.

Yes, having a low credit score doesn’t entirely prevent you from getting car insurance. However, it’s worth noting that your options might be somewhat restricted.

Particularly, if you’re looking to pay for your insurance in monthly instalments, some insurers may be hesitant to approve your application. This concern arises from the potential risk they perceive in your ability to make regular payments.

Nonetheless, the insurance market is broad and diverse, so with a bit of research and comparison, you should be able to find a provider that can accommodate your needs.

Yes, choosing to pay for your car insurance monthly can have an impact on your credit score. When you make these payments punctually every month, it can actually contribute positively to your credit score.

This is because your consistent monthly payments are recorded on your credit report, demonstrating your reliability as a borrower who responsibly manages their debts.

However, it’s crucial to be aware that any missed or late payments will have the opposite effect, leading to a decrease in your credit score. In severe cases, such lapses can even prompt your insurance provider to cancel your policy.

To ensure regularity in payments, setting up a Direct Debit is highly recommended. This way, your car insurance payments are automatically taken care of every month, significantly reducing the risk of missed or late payments and thus protecting your credit score.

No, if you choose to pay for your car insurance in one annual lump sum, a credit check is generally not required. This is because you’re covering the entire cost upfront, eliminating the need for a credit agreement which is typical with monthly payment plans.

Additionally, paying annually can often turn out to be more cost-effective since it usually doesn’t involve additional interest charges that can accumulate with monthly payments.

For short-term car insurance, a credit check is typically not required. This is because you usually pay for this type of insurance upfront, covering the entire cost of the policy at once.

Since there’s no credit agreement involved, as with longer-term, monthly payment plans, a credit check is generally not a part of the process for obtaining temporary car insurance.

No, named drivers that you add to your car insurance policy do not require a credit check.

The process of adding individuals as named drivers to your policy focuses on their driving history and other relevant factors, rather than their credit history. Therefore, a credit check isn’t necessary for them.

Yes, you have the right to refuse a credit check when applying for car insurance. However, it’s important to be aware that this decision might lead to the rejection of your insurance application.

Insurance providers usually perform credit checks to assess risk and determine payment terms, so refusing can affect their ability to evaluate your application.

To completely avoid a credit check, the most effective approach is to opt for paying the entire premium upfront for a year’s worth of car insurance. When you pay annually, the need for a credit check is typically bypassed, as the full payment is made in advance.

Additionally, insurance providers are expected to inform you before they conduct any credit check, so you should be made aware of this part of the process in advance.