Low-mileage car insurance cover

✔ Driving less often?

✔ Driving shorter distances?

✔ You could get cheaper car insurance

For individuals who use their car infrequently or don’t cover long distances, regular car insurance can often seem excessively expensive.

To address this, some insurers offer special car insurance policies designed specifically for low-mileage drivers. These policies can be a more affordable alternative to standard car insurance.

What is Low Mileage Car Insurance?

Understanding Low Mileage Car Insurance

Low-mileage car insurance is a specialised insurance policy designed for drivers who do not use their vehicles frequently. It’s particularly suitable for those who typically use their car for short distances or drive only on an occasional basis.

Who Benefits from Low Mileage Insurance?

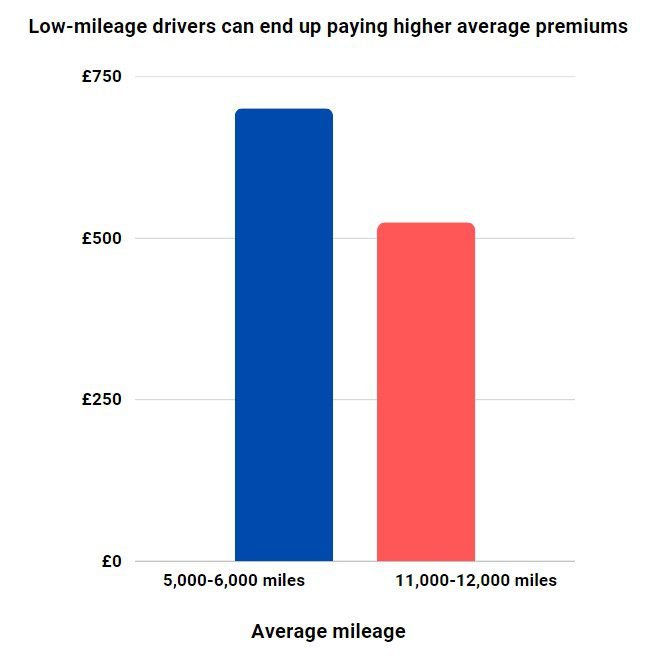

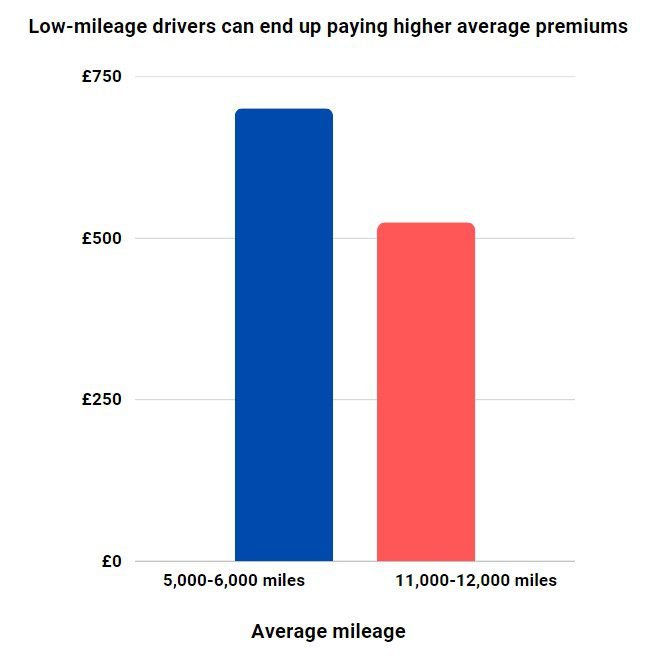

Drivers who clock less than 6,500 miles annually are the ideal candidates for this type of insurance. According to a study, a company specialising in low-mileage insurance, there’s a notable difference in insurance costs based on mileage.

For instance, individuals driving between 5,000 and 6,000 miles yearly could be paying around £210 more for their car insurance compared to those driving between 11,000 to 12,000 miles annually.

How Can You Save with Low Mileage Insurance?

Considering a low-mileage policy is a smart move for eligible drivers looking to reduce insurance costs. Many insurers offer plans that favour low-mileage drivers, leading to lower premiums.

Additionally, some providers offer pay-as-you-go options, charging drivers solely based on the miles they cover. This approach can be highly beneficial for those who use their cars infrequently.

Choosing the Right Policy

When searching for the right low-mileage car insurance, it’s crucial to compare different policies from various providers. This ensures you find a policy that not only fits your driving pattern but also aligns with your budget.

Opting for an insurance provider that rewards less frequent driving could significantly lower your insurance costs and lead to substantial savings on your premiums.

How much can you save on your car insurance?

How Does Low Mileage Car Insurance Work?

Pay-As-You-Go Approach

Low mileage car insurance operates on a pay-as-you-go basis. This involves installing a tracking device in your vehicle to record the distance you travel.

The key advantage here is cost-efficiency: the less you drive, the lower your risk of accidents, resulting in reduced premiums from your insurer due to the decreased risk.

Initial and Monthly Charges

Upon initiating your policy, you’ll typically pay a fixed annual fee. This fee covers risks such as theft, vandalism, or accidental damage when your car is stationary. Following this, at the end of each month, you’ll incur charges based on a per-mile rate for the miles you’ve driven.

Mileage Tracking and Reporting

The insurance company will provide you with a mileage tracker, which is straightforward to install and use.

This device transmits your mileage data to your insurer. You can often monitor this data through your insurer’s app or website, keeping you informed about your driving patterns and associated costs.

Mileage Limits and Insurance Claims

Different insurers have varied approaches regarding mileage limits. Some may allow you to purchase additional miles in 1,000-mile blocks, while others may charge you only for the actual distance you drive each month.

In the event of a claim, the process remains similar to that of a standard insurance policy, including the payment of an excess fee.

Flexibility and Cost-Savings

Low mileage car insurance is particularly beneficial for drivers who do not use their cars regularly or who generally travel short distances. By tracking your actual usage, insurers can offer more competitive rates to drivers with lower mileage.

Choosing the Right Policy

To ensure you get the most suitable cover, it’s important to compare policies from various insurers. Look for a policy that aligns with your driving habits and budget to find the best possible deal for low mileage car insurance.

How much can you save on your car insurance?

Who Can Benefit from Low Mileage Car Insurance?

Ideal Candidates for Low Mileage Insurance

Low mileage car insurance policies are particularly advantageous for drivers who do not use their cars often or only travel short distances.

If your driving habits involve daily commuting or long-distance travel, a standard insurance policy may be more appropriate. However, certain groups can significantly benefit from low mileage insurance:

Older Drivers

- OAPs (Older Age Pensioners) who do not travel frequently are ideal candidates. They typically use their cars occasionally and can thus benefit from lower insurance premiums.

Students

- Students who don’t have a car and need insurance occasionally, for instance, when driving a family member’s or friend’s car, can find low mileage policies cost-effective.

People Living Close to Work

- Employees residing near their workplace and driving infrequently can gain from a low mileage policy, especially if their car use is minimal.

Second Car Owners

- For those owning a second car that is used sporadically, a low mileage policy can be a cost-saving option.

Rideshare Users

- Individuals who predominantly carpool or use rideshare services for commuting can find low mileage insurance fitting for their limited car use.

Classic Car Enthusiasts

- Owners of classic cars, used mainly for shows or special events, can benefit from lower rates with a low mileage policy.

Advantages of Low Mileage Insurance

Lower Premiums

- Driving fewer miles categorises you as a lower risk, leading to lower insurance premiums compared to regular policies.

Increased Flexibility

- These policies tend to be more flexible, offering options like paying per mile driven or purchasing insurance in specific mileage blocks.

Environmental Benefits

- By driving less, you contribute to reducing carbon emissions and air pollution, making it a more environmentally friendly option.

Key Takeaway

Low-mileage car insurance policies offer an affordable solution for drivers with limited car use. If you fall into any of the aforementioned categories or have similar driving habits, it’s worth considering such a policy.

Remember to compare quotes from different insurers to find a policy that aligns with your driving habits and budget.

How much can you save on your car insurance?

What is Considered Low Mileage?

Understanding the National Average

In the UK, the average annual mileage for a car is around 6,500 miles, as reported by the Department of Transport. This figure serves as a general benchmark when considering what constitutes low mileage.

Insurer-Specific Thresholds

It’s important to note that insurance companies may have varying definitions of ‘low mileage’ for their car insurance policies. Each insurer sets its own threshold, which could differ from the national average.

Assessing Your Eligibility

If you find that your annual mileage is less than the national average, it might be beneficial to explore limited-mileage plans offered by your insurer. Opting for such a plan could lead to more favourable insurance terms and potentially lower premiums.

How much can you save on your car insurance?

How Do I Calculate My Mileage?

Importance of Accurate Estimation

When determining your annual mileage for a standard car insurance policy, it’s crucial to be as accurate as possible.

However, accurately estimating your mileage can be a bit tricky, especially if this is your first time. Thankfully, insurance companies usually offer some level of flexibility in this regard.

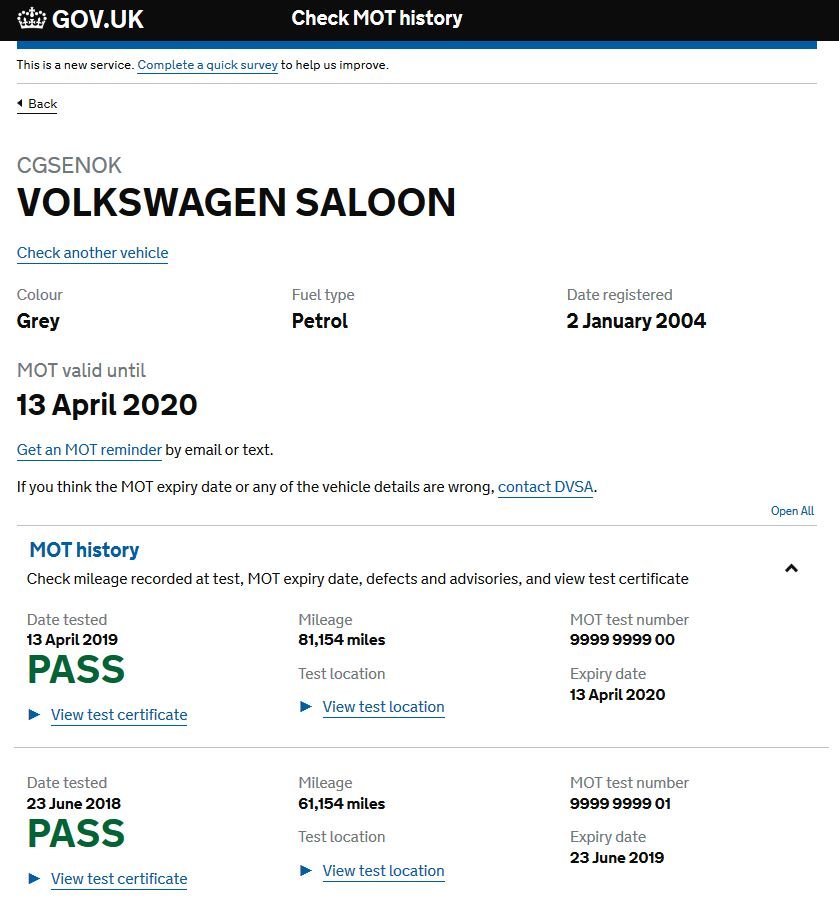

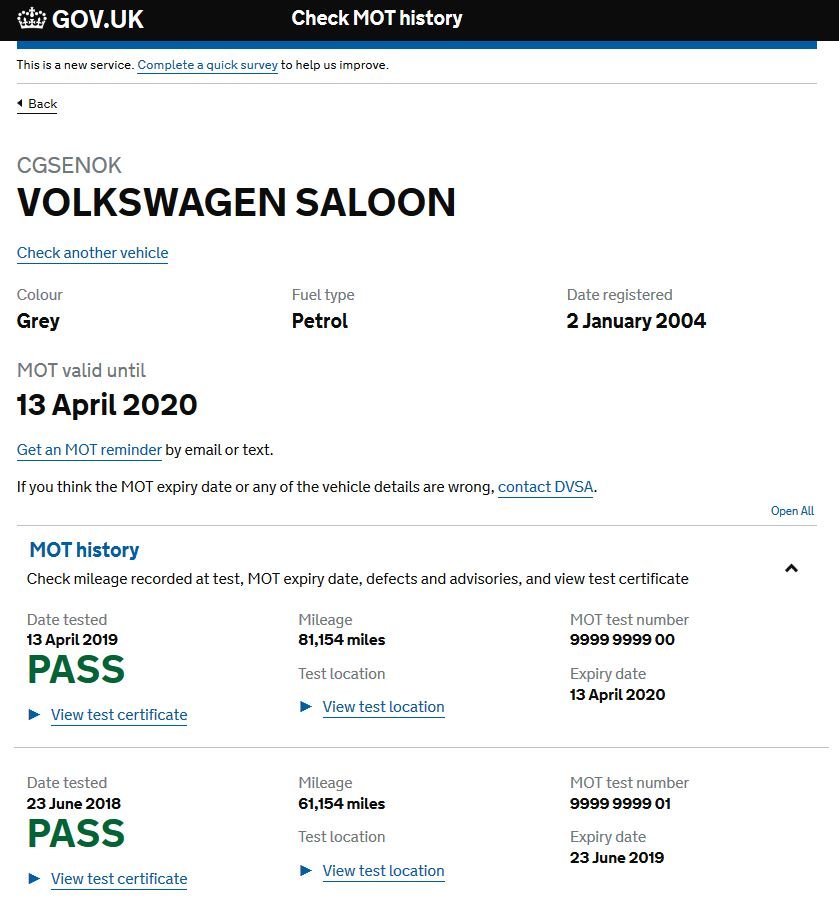

Using MOT Certificates

A practical method to gauge your yearly driving distance is to refer to your MOT certificates. These certificates record your vehicle’s mileage at each annual test, providing a reliable reference point.

Source: Open Government Licence v3.0

Factoring in Lifestyle Changes

It’s also vital to consider any significant lifestyle changes that might impact your driving habits:

- Job Changes: If you’ve recently switched jobs, your commuting distance may have altered, affecting your total annual mileage.

- Residential Moves: Moving to a new house can also change the distance you travel regularly.

- Visiting Friends and Family: Changes in the location of your friends or family can increase or decrease your mileage, depending on the frequency of your visits.

- Holiday Plans: Don’t forget to account for any long-distance driving holidays, as these can significantly add to your annual mileage.

By taking these factors into account, you can come up with a more accurate estimate of your annual mileage for your car insurance policy.

How much can you save on your car insurance?

What Happens if I Provide Incorrect Information About My Annual Mileage?

The Importance of Accurate Mileage Information

When securing a car insurance policy, it is crucial to provide precise details regarding your annual mileage.

Underestimating your mileage can lead to complications, particularly when you need to make an insurance claim. A substantial discrepancy between the mileage you declared and the actual mileage can raise serious issues.

Consequences of Inaccurate Mileage Reporting

Policy Invalidity

If your mileage information is found to be inaccurate, there’s a risk that your policy could be considered invalid. In such cases, your insurer might refuse to cover your claim, which means you would have to bear all associated costs yourself.

Risk of Insurance Fraud

Underreporting your mileage isn’t just a matter of incorrect information; it can be viewed as insurance fraud, which is a criminal offence. Being convicted of insurance fraud can lead to severe penalties, including substantial fines and potentially imprisonment.

Insurer Monitoring and Verification

Some insurers use tracking devices to monitor your car’s mileage. These devices make it easy for insurers to detect any discrepancies in the mileage you’ve reported. Therefore, honesty is paramount.

Updating Your Insurer

It’s advisable to inform your insurer if there’s a significant change in your mileage during the policy period. This proactive approach helps maintain the validity of your policy and prevents issues if you need to make a claim in the future.

How much can you save on your car insurance?

What Should I Do if I’m Going to Go Over My Mileage Limit?

Taking Action When Exceeding Mileage Limits

Realising that you might surpass your annual mileage limit on your car insurance policy requires immediate action. The first step is to promptly contact your insurance provider.

Adjusting Your Policy

Upon contacting them, discuss the possibility of adjusting your policy to include the extra mileage. While this adjustment might increase your insurance costs, it’s a far better alternative than facing the repercussions of an invalidated policy.

Risks of Exceeding Mileage Without Notification

Policy Invalidity

If you exceed your mileage limit without informing your insurer or amending your policy, you risk invalidating your insurance. This scenario can lead to your insurance claims being denied, making you liable for any expenses or damages resulting from an accident.

Claim Rejection

Failing to update your policy in light of increased mileage could result in claim rejections, leaving you financially responsible in the event of an accident.

Importance of Transparency

It’s essential to maintain transparency with your insurer regarding any changes in your driving habits or circumstances. Being upfront helps ensure you have the appropriate level of cover and can safeguard against future complications.

How much can you save on your car insurance?

What are the Different Types of Low Mileage Policies?

Overview of Low Mileage Policies

For drivers who don’t frequently use their cars, low mileage policies can be an effective way to save money on car insurance. There are several types of policies tailored to different driving habits and needs.

Pay-As-You-Go Policy

Tracking and Billing

A Pay-as-you-go policy involves using a tracker to monitor your mileage. Initially, you pay a fixed annual fee covering risks like theft, vandalism, or accidental damage while the car is parked. Then, at the end of each month, you’re charged a per-mile rate based on the actual miles driven.

Blackbox Insurance

Telematics-Based Premiums

Also known as telematics insurance, this policy involves your insurer monitoring various aspects of your driving. These include the distance you travel, the time of day you drive, and your driving style. Your premium can be adjusted based on these factors, either increasing or decreasing.

Short-Term Car Insurance

Temporary Cover

If your driving is only occasional, short-term or temporary car insurance might be more cost-effective than an annual policy. This type of insurance can last from a few days to several months, offering insurance cover only when you need it.

Classic Car Insurance

For Leisure Vehicles

Tailored for older, leisure-use vehicles, classic car insurance is ideal if you own a vintage or classic car. Given that these cars are typically driven less frequently than everyday vehicles, a classic car policy can be a very suitable option.

How much can you save on your car insurance?

Do I Still Need Car Insurance When I’m Not Driving My Vehicle?

Legal Requirements for Car Insurance

In the UK, it’s a legal requirement to have car insurance if your vehicle is parked on a public road or in a public car park. This is necessary even when you’re not actively driving your car, to cover potential risks like accidental damage or theft.

Statutory Off Road Notification (SORN)

Exemption from Insurance

If you have declared your car with a Statutory Off Road Notification (SORN), you are exempt from the requirement to insure your vehicle. SORN is applicable when you declare that your vehicle is kept off the road, for instance, in a private garage, and you have no plans to drive it.

Conditions and Restrictions

Under a SORN, you are not required to maintain insurance, but simultaneously, you are legally prohibited from driving the car on public roads. To use the vehicle again, you must cancel the SORN and ensure the car is properly insured.

How much can you save on your car insurance?

While driving less and maintaining low mileage can potentially lead to lower car insurance premiums, it’s not a certainty. Insurers consider a range of factors when determining your premium.

Multiple Considerations

Apart from mileage, insurers evaluate aspects like your age, driving history, the model of your car, and your location. These elements collectively influence the calculation of your insurance premium.

Risk Assessment

A reduction in mileage could make you appear as a lower-risk driver to your insurer, which might lead to a reduced premium. However, other factors can offset this. For instance, a recent speeding ticket might increase your premium, irrespective of your low mileage.

Just One of Many Factors

It’s important to recognise that low mileage is just one of the variables in the complex equation of insurance premium calculation.

Potential for Discounts

However, it’s always beneficial to inquire with your insurer about possible discounts for drivers who cover fewer miles annually. While not guaranteed, some insurers do offer incentives for low mileage.

How much can you save on your car insurance?

How Can I Reduce My Annual Mileage?

Strategies to Lower Mileage

Reducing your car’s annual mileage can lead to various benefits, including lower insurance premiums, decreased wear and tear on your vehicle, and potential savings on fuel and parking costs. Here are some effective ways to achieve this:

Carpooling

Sharing Rides

- Carpooling with a colleague or friend who works nearby is a great way to cut down on the miles you accumulate during your daily commute.

Public Transport

Alternative to Driving

- Opting for public transport options like buses or trains can make a significant difference in reducing your mileage. This choice is not only environmentally friendly, but it also contributes to potentially lower car insurance premiums.

Walking or Cycling

Short Journeys

- For shorter trips, consider walking or cycling. This approach doesn’t just decrease your mileage; it also offers health benefits and is an enjoyable way to experience your local surroundings.

Incorporating these methods into your routine can help you effectively reduce your annual mileage. This reduction not only has personal health and financial benefits but also positively impacts the environment.

How much can you save on your car insurance?

Compare low mileage car insurance

Comparoo is an online platform that makes it simple and straightforward to find low mileage car insurance policies from a range of insurance providers.

By using the platform, you can easily compare low-mileage policies with standard fully comprehensive, third-party only, and third-party, fire and theft policies. This allows you to choose the different options available to you and find the best car insurance policy for your specific needs and budget.

In addition, Comparoo provides you with valuable information about the policy features, benefits, and limitations, so you can make an informed decision.

Frequently asked questions

Specialist classic car insurance providers offer policies based on the assumption that classic cars are driven less frequently than regular cars.

Premiums may be adjusted accordingly, with some policies offering a discount for agreeing to a limited mileage. Others may impose mileage limits per year for classic cars.

Senior drivers over 60 who have a low annual mileage may be eligible for cheaper car insurance.

For drivers under 25, limited mileage policies may not be available. Seniors can check for specialist low-mileage cover and should review the policy for any age restrictions. They should also consider options designed specifically for seniors, as they may offer better deals.

When getting car insurance, it’s important to provide an accurate estimate of how many miles you drive each year. To do this, you can use the mileage history on your MOT certificate or compare your mileage from your annual service with the previous year.

It’s also important to consider any changes to your driving habits, such as retirement or travel plans. Underestimating could invalidate your insurance while overestimating could result in paying more than necessary.

Yes, car insurance companies may check your mileage, especially if you make a claim.

They may also compare your estimate with your MOT records. It is not advisable to underestimate your mileage to save on insurance, as it may lead to policy cancellation if your provider deems you misled them.

It’s crucial to provide accurate estimates and inform your provider if you’re likely to exceed your mileage limit.

The impact of low mileage on car insurance premiums is not always straightforward, as insurance providers may also take other factors into account such as driving experience.

While low mileage can lower insurance premiums, it is not the only factor that determines the cost of car insurance.

In the UK, it is a legal requirement to insure your car even if you are not driving it as long as it is on public roads.

To stop paying for insurance, you must declare it off-road by making a Statutory Off Road Notification (SORN) through the DVLA. Once you declare your car off-road, you cannot drive it on a public road and must park it in a garage, driveway, or private land.

It is important to remember that if your car is not insured and gets damaged while parked, you won’t be able to make a claim.

To be eligible for low-mileage car insurance discounts, driving under 7,500 or 8,000 miles per year is generally required.

However, some insurance companies may offer discounts if you drive fewer miles than the national average of 13,500 miles per year.

Insurers consider mileage as one of the important factors when calculating car insurance premiums.

Underestimating the mileage on your policy can lead to the invalidation of your insurance policy, so it’s important to estimate accurately.

On average, cars in the UK drive 20 miles per day, 142 miles per week, 617 miles per month, and 7,400 miles per year. – NimbleFins.co.uk