Compare cheap car insurance

✔ Compare cheap car insurance quotes

✔ Over 110 insurance providers

✔ Get a quote in minutes

✔ Save up to £504*

If you happen to encounter the unfortunate event of a broken car window, it’s imperative to take swift action, regardless of whether it resulted from an unexpected cricket ball or a more serious incident like vandalism or a car crash.

- Will my car insurance cover broken windows?

- How do I make a claim for a broken car window?

- Will I lose my no-claims discount if I claim for a broken window?

- How much will it cost to replace my car window?

- What if my windscreen is broken, cracked or chipped?

- Frequently asked questions

Promptly addressing this issue is crucial, so if you find yourself in such a situation, here’s what you should do.

Will my car insurance cover broken windows?

The cover for broken car windows under your car insurance policy is contingent upon the specifics of your policy. Different insurance providers have varying approaches in this regard.

Some may include glass damage cover as a standard feature, while others may offer it as an optional add-on with an additional cost. It’s important to note that window cover is not always automatically included, and even if it is, certain conditions or limitations might apply.

To ascertain the details of your cover, the best course of action is to carefully review the fine print of your policy. Alternatively, you can quickly reach out to your insurance provider through a phone call or email to seek clarification and ensure you have a clear understanding of your cover in the event of broken car windows.

How much can you save on your car insurance?

How do I make a claim for a broken car window?

To initiate a claim for a broken car window, the procedure generally follows the same steps as any other insurance claim. Most insurance providers offer a 24-hour helpline specifically for reporting damages as soon as they are noticed.

For comprehensive guidance on the claims process and subsequent proceedings, it is advisable to refer to your policy documents. These documents should provide a step-by-step outline of the necessary actions to take and the information required to proceed with your claim.

It’s important to note that there may be a time limit within which you must file your claim, so it’s best not to delay if you intend to utilise your insurance cover to address the issue.

Any such clauses pertaining to time limitations should be explicitly outlined in your policy. If you don’t have immediate access to your policy documents, you can often find the relevant information on your insurance provider’s website or by contacting their customer service.

How much can you save on your car insurance?

Will I lose my no-claims discount if I claim for a broken window?

In most cases, you won’t lose your no-claims discount if you make a claim for a broken car window. The majority of insurance providers understand that window damage is often beyond your control and unrelated to your driving behaviour.

Therefore, they typically leave your hard-earned no-claims discount intact even after such a claim.

To be absolutely certain about the impact on your no-claims discount, it is advisable to review your policy documents. This knowledge can be particularly valuable if you have diligently built up your no-claims discount over time and wish to preserve it.

It’s worth noting that this information might influence your decision on whether to file a claim or opt to cover the repair expenses yourself, especially if you are financially capable of doing so.

How much can you save on your car insurance?

How much will it cost to replace my car window?

The cost of replacing your car window will vary depending on your location and the specific make and model of your vehicle if you opt to pay for the replacement yourself.

If you choose to go through your insurance provider for the replacement, the expense will be determined by the terms and conditions outlined in your policy. This may include factors such as the excess amount that you need to pay out of pocket.

If you’re contemplating whether to file a claim or not, it’s prudent to calculate the overall costs involved. For instance, if the replacement is a minor job with an estimated cost of around £100, but your excess amount is £200, it might be more cost-effective to handle the repair independently.

If you decide to pursue a self-funded repair, it’s always advisable to compare prices and gather quotes from multiple garages before committing. This way, you can ensure you’re obtaining the best possible price for the replacement service.

Shopping around helps you make an informed decision and ensures you’re receiving a competitive offer.

How much can you save on your car insurance?

What if my windscreen is broken, cracked or chipped?

If your windscreen is broken, cracked, or chipped, it’s crucial to address the issue promptly due to the potential risks it poses. A damaged windscreen not only hampers visibility but also compromises the structural integrity of your vehicle.

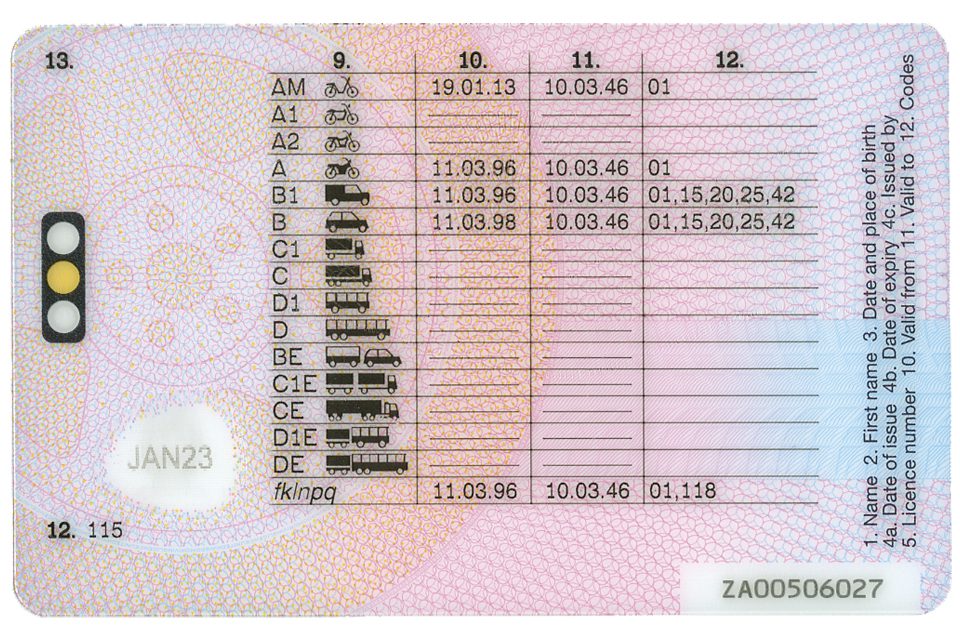

Driving with a damaged windscreen is hazardous and may result in penalties, including fines and penalty points on your driver’s licence. Therefore, if you notice any chips or cracks on your windscreen, it is essential to have them repaired without delay.

Postponing the repair is ill-advised, as cracks have a tendency to expand rapidly and can spread across the entire windscreen, creating an extremely perilous situation.

Any automotive glass specialist who deals with car windows should be able to repair your windscreen. If you are covering the cost of repair or replacement yourself, it’s important to note that the expense will vary depending on your location and the type of car you own.

However, before proceeding with the repair, it’s worth checking if your car insurance includes windscreen cover. This cover could potentially save you from incurring the expenses personally.

Take the time to review your insurance policy and determine the extent of your cover for windscreen repairs or replacements. Additionally, consider the cost implications of making an insurance claim, including any excess amount you would be responsible for paying, as it varies based on the terms and conditions specified in your policy.

Frequently asked questions

When it comes to driving with a broken car window, it is essential to prioritise clear visibility and ensure that you can see clearly through the windscreen, side windows, and rear windows of your vehicle.

Maintaining visibility is crucial for safe driving, allowing you to stay aware of other vehicles, pedestrians, and potential hazards on the road.

According to the guidelines outlined in the Highway Code:

- Windscreens and windows MUST be kept clean and free from obstructions to vision

Learn more about the rules for vehicle maintenance in the Highway Code.

While it may seem tempting to continue driving with a broken window or attempt a temporary fix such as placing a plastic bag over the window, it’s important to note that such actions could potentially be considered a motoring offence.

It’s crucial to comply with the regulations and prioritise the safety of yourself and others on the road by ensuring clear visibility at all times.

If you have a chip or damage on your car’s side window, unfortunately, it cannot be repaired and will require a replacement. Side windows are constructed differently and cannot undergo repair. Even a small chip in the glass necessitates the entire window to be replaced.

However, the situation is different when it comes to your windscreen. If your windscreen sustains a chip, it can often be swiftly repaired. The cost of such repairs typically ranges from £40 to £200, depending on the repairer and the specific circumstances of the damage.

If you’re experiencing issues with your electric car window, there are several potential causes to consider. One possibility is a problem with the window switch itself. You can try using an alternative switch, if available, to determine if the issue persists.

Other common causes can include a blown fuse, which may require replacement or difficulties in supplying power to the window motor.

Additionally, mechanical problems with the motor or issues with the window regulator, which prevents the window from closing in the presence of obstructions, could be the underlying reasons for the malfunction.

It’s worth noting that extremely cold temperatures can also impact the smooth operation of car windows, causing them to become less responsive or stuck.

To diagnose and address the issue effectively, it may be necessary to consult a professional automotive technician who can perform a thorough inspection and identify the specific cause of the problem with your electric car window.

If you’re experiencing issues with your electric car windows, there are several steps you can take to address the problem. First, consult your car’s manual or owner’s guide, as it often contains helpful suggestions and troubleshooting tips specific to your vehicle.

For example, you may find guidance on how to replace a fuse that could be causing the issue. If the manual does not provide a solution, it may be necessary to take your vehicle to a qualified repair service to diagnose and resolve the problem.

To ensure the long-term smooth operation of your electric car windows, it’s recommended to practice a good habit. Once the window is fully raised or lowered, it’s advisable to release the button promptly.

Keeping the button pressed unnecessarily can place undue stress on the window motor over time. By releasing the button as soon as the window reaches its desired position, you can help maintain the optimal functioning of the motor and extend its lifespan.