Compare cheap car insurance

✔ Compare cheap car insurance quotes

✔ Over 110 insurance providers

✔ Get a quote in minutes

✔ Save up to £504*

Exciting news! You now have the joy of owning a shiny new car. Of course, safeguarding it is a top priority for you.

With new for old car insurance, you have the fantastic opportunity to have your vehicle replaced with a sparkling brand-new car in the unfortunate event of theft or irreparable damage.

- What is new for old car insurance?

- How does new for old car insurance work?

- What incidents are covered by new for old car insurance?

- What incidents aren’t covered by new for old car insurance?

- What happens if I don’t have new for old car insurance and my car is written off?

- Is new for old car insurance worth it?

- Frequently asked questions

This means that if anything were to happen to your prized possession, rest assured that you’re fully covered and can get back on the road with a gleaming new motor.

What is new for old car insurance?

New for old car insurance provides you with a remarkable benefit: a like-for-like replacement if your beloved new car is deemed a write-off or falls victim to theft.

Typically, this cover applies to vehicles less than a year old, where the cost of repairs surpasses the car’s value.

Under the umbrella of new for old car insurance, your insurance provider takes on the responsibility of replacing your vehicle with one that matches the same age, mileage, make, and model as your original car.

In the event that a similar car is unavailable, they may even offer you the cash equivalent to purchase a replacement on your own.

It’s worth noting that certain insurance providers include new for old car insurance as a standard feature in their policies. It’s prudent to review your current policy to determine if this cover is already included. If not, fret not! You may have the option to acquire it as an add-on to your existing cover.

How much can you save on your car insurance?

How does new for old car insurance work?

In order to benefit from new for old replacement car insurance, specific criteria must be met by your car. These criteria typically include:

- Age – Typically, your car should be less than a year old to be eligible for a like-for-like replacement in the event of a claim.

- Damage – The cost of repairs to your vehicle must surpass a certain threshold to justify a replacement car under this cover.

- Mileage – Some insurance providers impose a mileage limit on new for old policies, so it’s essential to be aware of any such restrictions.

- Ownership – You must be able to provide evidence of car ownership, and in some cases, it may be necessary to prove that you are the first registered keeper of the vehicle.

It’s worth noting that depending on your insurance provider, there may be additional exclusions and conditions. To obtain comprehensive information, it is crucial to carefully review the terms and conditions outlined in your policy.

By doing so, you’ll gain a clearer understanding of the specific details and any other provisions that may apply to your new for old car insurance cover.

Who should consider new for old car insurance?

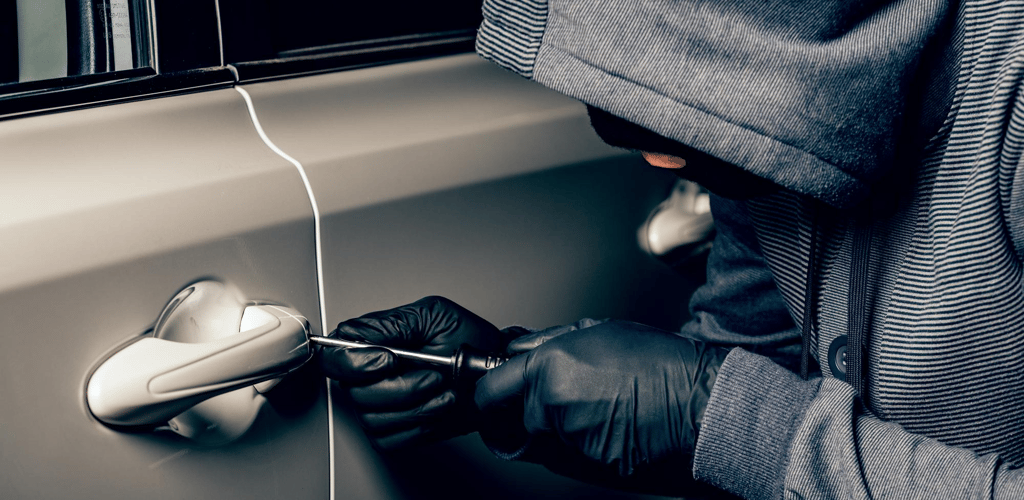

If you have recently purchased a brand-new car, especially one that falls into the category of being expensive and appealing to potential thieves, it is highly advisable to give serious thought to obtaining new for old car insurance.

How much can you save on your car insurance?

What incidents are covered by new for old car insurance?

The specific cover provided by your new for old car insurance policy will be outlined in the terms and conditions. However, in general, it should encompass the following:

-

Theft – If your car is unfortunately stolen and not subsequently recovered, new for old car insurance should come to your aid in providing the necessary support and compensation.

-

Excessive Damage – In the event that your car sustains significant damage that renders it uneconomical to repair or “written off” by insurance standards, your new for old car insurance cover should step in to assist you.

While these are common scenarios covered by new for old car insurance, it is essential to thoroughly review the specifics of your policy to ensure you have a clear understanding of the incidents covered and any potential limitations or exclusions that may apply.

This way, you can have peace of mind knowing that you have suitable protection for your valuable vehicle.

How much can you save on your car insurance?

What incidents aren’t covered by new for old car insurance?

While the specifics may vary depending on your policy, it is common to find certain exclusions in new for old car insurance. These exclusions may include:

-

Superficial Damage – Typically, new for old car insurance focuses on providing cover for significant incidents that render the vehicle unusable or substantially diminish its value. Superficial damage, such as minor scratches or cosmetic issues, may not be covered under this policy.

-

Misrepresentation of Information – It is crucial to provide accurate and truthful information when obtaining new for old car insurance. If it is discovered that false or inaccurate information was intentionally provided, it may lead to the denial of cover.

-

Unsafe or Reckless Driving – Engaging in unsafe or reckless driving practices, such as driving under the influence of alcohol or drugs, may invalidate your new for old car insurance cover. It is essential to adhere to traffic laws and maintain responsible driving habits to ensure the validity of your policy.

Remember to carefully review the terms and conditions of your specific policy to gain a comprehensive understanding of the incidents that are excluded from cover.

Being well-informed about these exclusions allows you to make informed decisions and take appropriate measures to protect yourself and your vehicle.

How much can you save on your car insurance?

What happens if I don’t have new for old car insurance and my car is written off?

In the unfortunate event that you lack new for old car insurance cover and your car is deemed a write-off, your insurance provider will typically offer you the current market value of your vehicle.

The drawback of this scenario is that your car’s value would have inevitably depreciated since the time of purchase. According to the AA, it is estimated that a new car experiences a depreciation of approximately 40% by the end of its first year alone.

This means that without new for old car insurance, you may receive a payout that is significantly lower than the initial amount you paid for your car.

It’s important to consider this potential financial shortfall when determining the appropriate level of insurance cover for your vehicle.

By opting for new for old car insurance, you can safeguard yourself against the depreciation and potential loss of value, ensuring that you can replace your car with a comparable model if it is written off.

How much can you save on your car insurance?

Is new for old car insurance worth it?

New for old car insurance offers a valuable sense of security by assuring you that you will have the means to replace your new car if it is stolen or written off within the initial year of ownership.

Top tip: Determining whether new for old car insurance is worth it can be challenging since it’s impossible to predict the future and anticipate what might happen to your car.

While the exact number of cars written off each year remains unclear, statistics from AA Insurance reveal a significant surge in car theft incidents, with a staggering 25% increase reported in 2022 compared to the previous year.

This highlights the potential risks associated with car ownership, emphasising the importance of having comprehensive cover to safeguard against unforeseen events.

Ultimately, the decision to invest in new for old car insurance depends on your personal circumstances, the value of your vehicle, and your appetite for financial risk.

Evaluating the potential benefits and considering the rising instances of car theft can assist you in making an informed choice that aligns with your needs and provides you with the peace of mind you deserve.

Frequently asked questions

Agreed value car insurance serves as an alternative to new for old replacement car insurance, specifically designed for higher-value vehicles. When getting this type of cover, you and your insurance provider establish an agreed-upon value for your vehicle.

During the policy inception, you determine the amount required to purchase a replacement car of similar make, model, and condition. In the unfortunate event of your car being written off or stolen, your car insurance provider will compensate you with the predetermined agreed amount.

Agreed value car insurance offers a tailored approach for individuals who own vehicles with significant value. By establishing a specific amount upfront, you can have greater certainty in receiving appropriate compensation in case of a total loss or theft.

It’s important to note that agreed-value car insurance may have certain eligibility requirements and conditions specific to each policy. Consulting with your insurance provider and carefully reviewing the terms and cover details will enable you to make an informed decision that suits your needs and protects your valuable asset.

An additional method to safeguard your new car is through the utilisation of Guaranteed Asset Protection (GAP) insurance. GAP insurance serves as a protective measure that covers the disparity between the payout provided by your car insurance and the original purchase price of your vehicle.

This cover is particularly valuable in situations where there are outstanding loans or finance agreements associated with your car.

The purpose of GAP insurance is to bridge the gap between the amount you receive from your primary car insurance policy in the event of a total loss or theft, and the actual amount you paid when purchasing the vehicle.

By having GAP insurance in place, you can ensure that any remaining loan balance or financial obligations are fully addressed and settled.

It’s important to note that while we do not currently offer a comparison service for GAP insurance products, you may explore this cover option with your insurance provider or seek advice from a reputable financial institution to determine the best solution for your specific circumstances.