Compare cheap car insurance

✔ Compare cheap car insurance quotes

✔ Over 110 insurance providers

✔ Get a quote in minutes

✔ Save up to £504*

Different driving licences exist because of many reasons – our ultimate guide explains how the driving licence type you hold can change how much you pay for car insurance.

Does Your Driving Licence Affect Your Car Insurance?

Type of Licence

The type of licence you have is a significant factor in determining your car insurance. Different types of licences can indicate varying levels of driving experience and expertise, which insurers consider when calculating premiums.

Convictions and Points

Having convictions or penalty points on your licence can also impact your insurance costs. These marks are often seen as indicators of risky driving behaviour, leading to higher insurance premiums.

Declared Health Issues

If you’ve declared any health problems on your licence, this could also affect your insurance. Health conditions that might impair your driving ability can make you a higher risk in the eyes of insurers, potentially leading to increased premiums.

Length of Licence Ownership

The duration for which you’ve held your licence is another important factor. Generally, the longer you’ve held your licence, the more experienced a driver you’re considered to be, which can often result in lower insurance costs.

How much can you save on your car insurance?

Do I have to give my insurer my driving licence information?

No, you don’t have to share your driving licence number when searching for car insurance. But there’s a service called MyLicence, made by the DVLA and MIB. They use your licence number to check your driving details.

This helps them give you a better car insurance price based on your driving history. You don’t need to enter all the information, so you won’t make a mistake that could invalidate your policy.

Do I Have to Give My Insurer My Driving Licence Information?

You are not required to provide your driving licence number when you are searching for car insurance. However, it’s beneficial to be aware of the MyLicence service, which is a collaboration between the DVLA and the Motor Insurers’ Bureau (MIB).

Benefits of MyLicence

MyLicence allows insurers to access your driving record using your licence number. This service can be quite helpful in ensuring that insurers offer you a car insurance quote that accurately reflects your driving history.

By using MyLicence, the risk of errors is reduced, as you don’t need to manually input all your driving details. This minimises the chance of making a mistake that could potentially invalidate your policy.

How much can you save on your car insurance?

What Types of Driving Licence Are There?

UK Car Licence

To legally drive in the UK, one of the acceptable types of licences is a complete UK car licence. This is the standard licence issued to drivers in the United Kingdom.

EU Licence

Another valid option is a full EU licence. If you have a licence from a country that is part of the European Union, it’s recognised for driving in the UK.

European (Non-EU) Licence

For those from countries in Europe but outside the European Union, a whole European (Non-EU) licence is also accepted for driving in the UK.

International Licence

Lastly, a total international licence from countries outside of Europe is also recognised for driving in the UK. This type of licence is applicable for drivers from various international regions.

How much can you save on your car insurance?

Is Car Insurance More Expensive with a Non-UK Driving Licence?

Higher Insurance Costs for International Licences

Typically, car insurance tends to be more expensive for individuals holding international driving licences.

Insurers often view drivers with non-UK licences as higher risk due to potential inexperience with UK road conditions, local traffic rules, or being used to driving on a different side of the road.

No-Claims Discount Transfer Issues

A significant factor in this increased cost is the difficulty in transferring your no-claims discount with a non-UK licence. However, there are some specialist insurers in the market that may allow the transfer of your no-claims bonus.

It’s highly recommended to shop around for cover, as successfully transferring your no-claims bonus can lead to a substantial reduction in your premiums.

Challenges with International Licences

Some insurance companies may have limited experience in dealing with international licences, which can result in higher insurance quotes. As a holder of a non-UK licence, you might also encounter stricter terms and conditions.

This could include limitations on the types of vehicles you’re permitted to drive or restrictions on driving in certain areas.

Finding the Best Insurance Deal

To secure the deal, compare car insurance quotes from over 110 of the UK most trust insurance providers with Comparoo. Additionally, contacting specialist insurers who have expertise in catering to international drivers can be a prudent step.

How much can you save on your car insurance?

What Types of Full UK Driving Licences Are There?

Standard Full UK Car Licence

Once you’ve successfully passed your practical and theory tests, you’ll receive a full UK driving licence. This licence categorises the vehicles you’re allowed to drive based on their specific classification.

One common type is the Standard full UK car licence, which enables you to drive both automatic and manual cars on UK roads.

Automatic Cars Only Licence

There’s also a licence specifically for automatic cars, known as the Full UK car licence for automatic cars only. This licence restricts you to driving vehicles with automatic transmission only.

Advanced Driving Course Licences

For those who have undertaken additional training, there are specialised licences such as the Full UK car licence with IAM, signifying that you’ve completed and passed an advanced driving course with IAM RoadSmart.

Similarly, the Full UK car licence with Pass Plus indicates passing an alternative advanced driving course with Pass Plus.

Medical Restricted Licence

There’s also the Medical restricted full UK car licence, issued to individuals with certain medical conditions that might affect their driving abilities. A detailed list of these conditions is available on the government’s website.

Understanding Licence Requirements

Each type of licence comes with its own set of requirements and restrictions. To make sure you have the appropriate licence for your driving needs, it’s advisable to refer to the UK government’s website or seek advice from a qualified driving instructor.

How much can you save on your car insurance?

Can I Drive in the UK Without a Full Driving Licence?

Acquiring a UK Provisional Licence

If you don’t have a full driving licence, you can still drive in the UK by obtaining a UK provisional licence.

This licence is primarily designed for learning and practising driving under specific conditions. You become eligible to take the UK driving test after residing in the UK for six months.

Restrictions with a Provisional Licence

When driving with a provisional licence, there are several important restrictions you must adhere to:

- You must be accompanied by a person who is at least 21 years old and has held a full UK driving licence for a minimum of three years.

- “L” plates (or “D” plates in Wales) must be displayed on the front and rear of the vehicle.

- You are not permitted to drive on motorways, unless you are accompanied by an approved driving instructor in a dual-control car.

Additional Restrictions for Young Drivers

For drivers under 18 years old holding a motorway driving licence, there’s an additional restriction: you are not allowed to drive between midnight and 5 am.

Importance of Adhering to Rules

It’s crucial to follow these rules diligently. Failure to comply with these restrictions can lead to penalties or even disqualification from obtaining a full driving licence in the future.

How much can you save on your car insurance?

Will I Need Car Insurance to Drive in the UK?

Mandatory Third-Party Insurance

In the UK, it is a legal requirement for all cars to have at least third-party car insurance to be driven on public roads. This requirement is in line with the continuous insurance enforcement rules.

Bringing Your Own Car to the UK

If you’re planning to bring your own car to the UK, your current insurance policy should provide third-party cover. However, it’s important to note that you may need a green card to demonstrate that your insurance is valid in the UK.

Renting a Car in the UK

For those renting a car in the UK, typically, there’s no need to obtain a separate insurance policy. This is because insurance is usually included in the rental fee.

Purchasing or Borrowing a Car in the UK

In the event that you purchase a car in the UK, you are required to obtain a UK car insurance policy. Similarly, if you are borrowing a car from friends or family, you need to be added to their policy as a named driver.

Importance of Adequate Insurance Cover

Having adequate insurance cover is essential. Not only does it help you avoid legal penalties, but it also ensures financial protection in case of accidents or other incidents while driving on the road.

How much can you save on your car insurance?

What Types of Non-UK Driving Licences Are There?

EU/EEC Licences

If your driving licence was issued in a European Union (EU) or European Economic Community (EEC) country, you can use it in the UK until it expires. You won’t need to retake your test or exchange it for a UK licence.

The expiry of your EU/EEC licence will either be when you turn 70 or three years after becoming a UK resident, whichever is later.

However, if you exchanged a non-EU licence for an EU one, you’ll need to pass a UK driving test after 12 months.

This is due to the potential lack of a licence exchange agreement between the UK and the country where your original licence was issued.

Exchangeable International Licence

If your licence was issued in the Isle of Man, Jersey, Guernsey, Gibraltar, or any designated countries like Australia, Barbados, Canada, and others, you can drive in the UK for up to 12 months.

- Australia

- Barbados

- British Virgin Islands

- Canada

- Falkland Islands

- Faroe Islands

- Hong Kong

- Japan

- Monaco

- New Zealand

- Republic of Korea

- Singapore

- South Africa

- Switzerland

- Zimbabwe

After this period, you can exchange your licence for a full UK licence without retaking your test, provided you do so within five years of becoming a UK resident.

Non-Exchangeable International Licence

For licences issued by countries outside the EU, EEC, or the designated countries, you are permitted to drive in the UK for 12 months. Once this period ends, you must pass the UK driving test to obtain a full UK licence.

While driving lessons are not mandatory, they can be beneficial in familiarising yourself with UK driving rules and conditions. Don’t forget to apply for a provisional UK licence before taking the driving test.

Staying Informed and Compliant

It’s crucial to stay informed about any changes in driving licence regulations, especially considering the evolving relationship between the UK and the EU. Keeping track of these changes ensures you maintain legal driving status in the UK.

How much can you save on your car insurance?

How Can I Reduce the Cost of Cover If I Have a Non-UK Driving Licence?

Choosing a Manual Car

Opting for a manual car can be a cost-effective decision. Manual vehicles typically come with lower insurance premiums compared to their automatic counterparts, as automatic gearboxes are costlier to repair or replace.

Furthermore, holding a full driving licence instead of an automatic-only licence can lead to additional reductions in your insurance costs.

Enrolling in Driving Courses

Participating in driving courses like Pass Plus and IAM might not always directly result in cheaper car insurance, but they can be particularly advantageous for younger or less experienced drivers.

These courses can enhance your driving skills and might lead to lower insurance rates.

Obtaining a UK Licence

If you possess an EU, EEC, or exchangeable international licence, exchanging it for a UK licence after residing in the country for six months can be beneficial.

This can help you qualify for discounts on your insurance premiums, especially for longer stays. On the other hand, if you have a non-exchangeable licence, you’ll need to apply for a provisional licence and pass the UK driving test after being a resident for six months.

By considering these options, you can potentially lower your car insurance costs while ensuring you meet the legal requirements for driving in the UK. It’s important to explore various avenues to find the most financially advantageous solution for your circumstances.

How much can you save on your car insurance?

Do Driving Convictions Affect the Cost of Car Insurance?

Impact of Convictions on Insurance Costs

Driving convictions on your licence will indeed lead to an increase in the cost of your car insurance. Some insurers may refuse to offer cover, while others might charge significantly higher premiums.

This is because individuals with a history of driving convictions, such as speeding, drink-driving, or other traffic offences, are statistically more likely to make insurance claims, representing a higher risk to insurers.

Finding Insurance with Convictions

Despite these challenges, there are steps you can take to improve your chances of securing a more favourable insurance deal:

- Shop Around: Compare different insurance providers. Some may be more accommodating to drivers with convictions.

- Specialist Insurers: Look for insurers specialising in covering drivers with convictions or higher-risk profiles.

- Improve Driving Habits: Work on improving your driving. Avoid further convictions by taking a defensive driving course and adhering to speed limits.

Long-Term Improvements

Over time, as convictions become spent or are removed from your driving record, your options for car insurance may widen, and your premiums could decrease.

Proactive Approach to Insurance

By being proactive and careful in selecting the right cover, you can still obtain car insurance despite having driving convictions. It’s about finding insurers that understand your situation and are willing to provide cover that meets your needs.

How much can you save on your car insurance?

Do I Have to Tell My Insurer About My Driving Convictions?

Reporting Unspent Convictions

You are required to inform your insurer about any driving convictions that are still unspent. Convictions are considered unspent for a certain period, depending on the severity and type of the offence. Once this period passes and the conviction becomes spent, there is no longer a need to disclose it to your insurer.

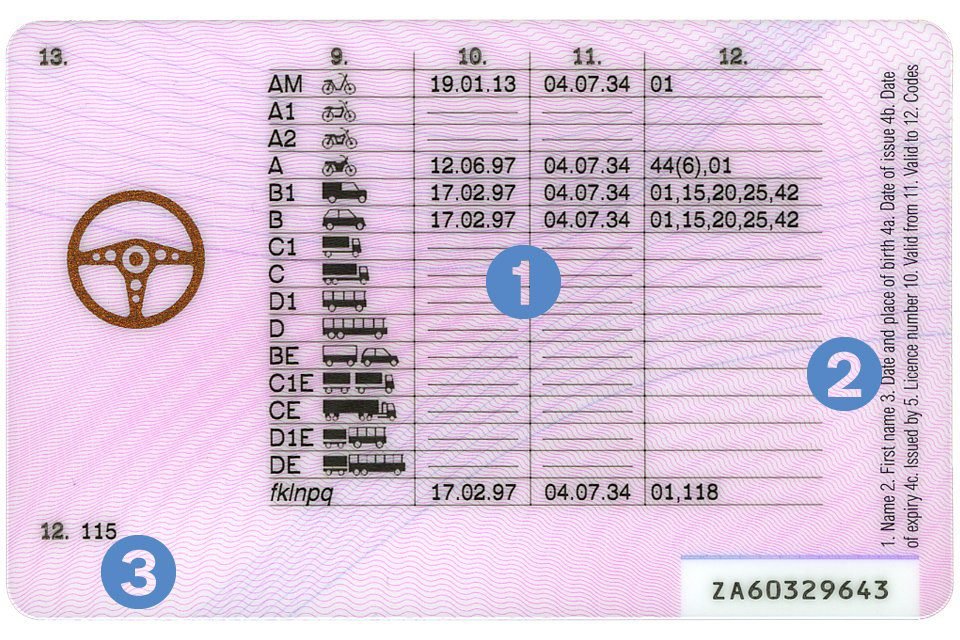

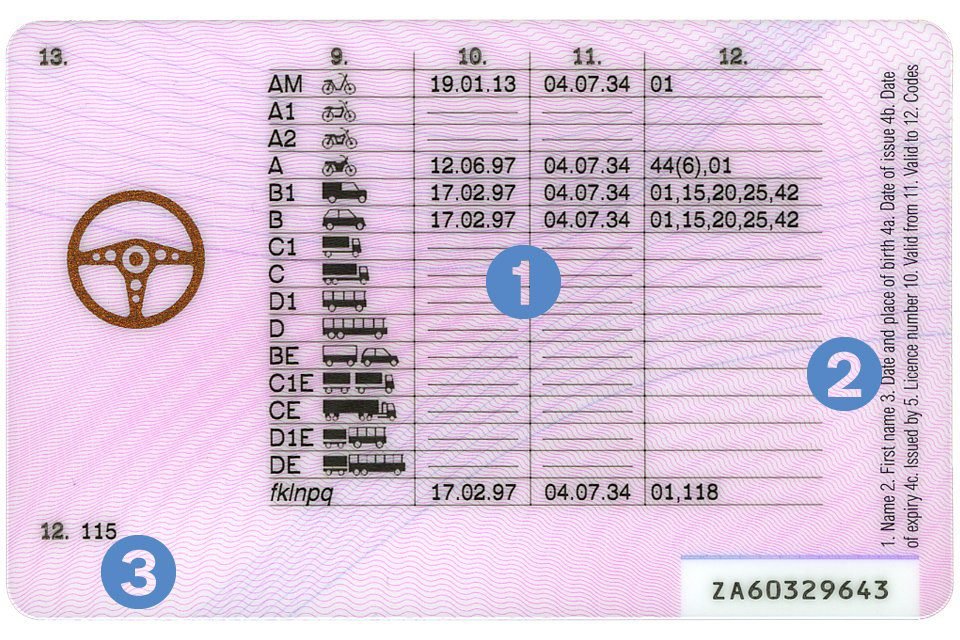

Checking Your Driving Licence

To determine whether you have any points or unspent convictions, it’s essential to check your driving licence. This will give you a clear understanding of your current driving record.

Honesty is Crucial

It’s vital to be honest and upfront about any unspent convictions. Hiding or lying about your driving history can lead to serious consequences.

If your insurer discovers that you have withheld information about your convictions, your car insurance policy could be declared void. This means you would not be covered in the event of an accident or claim.

Maintaining Insurance Integrity

To maintain the integrity of your insurance policy and ensure you are adequately covered, always provide accurate and complete information about your driving history to your insurer. This is key to avoiding complications and ensuring that your insurance is valid and effective.

How much can you save on your car insurance?

Impact of Specific Convictions

Different driving offences can have varying impacts on your car insurance premiums. Some offences may significantly increase your premiums due to the heightened risk they represent to insurers.

Speeding

Speeding is a frequent offence that often leads to increased premiums. Insurers view drivers with a history of speeding as a higher risk, which is reflected in their insurance costs.

Drink-Driving

Drink-driving is a severe offence that can result in a substantial increase in insurance premiums. This reflects the serious risk associated with impaired driving.

Using a Mobile Phone While Driving

This offence is becoming more common and is likely to lead to higher premiums. It indicates a likelihood of being distracted while driving, which insurers consider risky.

Driving Without Insurance

Being convicted of driving without insurance significantly impacts your future premiums. Insurers deem such drivers as high-risk, which is reflected in the increased costs.

In addition to driving convictions, other factors also play a significant role in determining the overall cost of your car insurance policy. These include the driver’s age, location, type of car, annual mileage, and vehicle security measures.

Finding the Best Insurance Deal

To ensure you get the best possible deal tailored to your specific circumstances, it’s crucial to compare quotes from multiple insurance providers.

This allows you to evaluate different options and select a policy that offers the best balance of cover and cost, considering your driving history and other relevant factors.

How much can you save on your car insurance?

What If I Have More Than One Conviction on My Licence?

Impact of Multiple Convictions

If you have multiple convictions on your driving licence, it’s likely to result in a more significant increase in your insurance premiums. Insurers typically perceive drivers with several convictions as posing a higher risk.

This perception of increased risk often leads to higher premiums, as insurers anticipate a greater likelihood of future claims.

In such cases, it’s important to be aware that while your insurance costs may be higher, there are still ways to find relatively affordable cover.

Shopping around and comparing car insurance quotes from various insurers can help you find a policy that balances cost and coverage, even with multiple convictions on your record.

How much can you save on your car insurance?

Will Having a Medical Condition Affect My Car Insurance?

Disclosure of Medical Conditions

If you have a medical condition that could impact your driving, it may indeed affect your car insurance. It’s particularly important if the condition is one that needs to be reported to the DVLA.

When applying for car insurance, you’ll need to disclose any relevant medical conditions and provide details about any restrictions on your licence.

Medical conditions that might impair your driving abilities, such as diabetes, epilepsy, or sleep apnoea, can lead insurers to view you as a higher risk. As a result, your insurance premiums might be higher compared to someone without such medical conditions.

Managing Car Insurance Costs

To potentially reduce the impact on your insurance costs, consider these steps:

- Shop Around: Obtain quotes from multiple insurance providers. Different insurers may offer more favourable rates for drivers with specific medical conditions.

- Specialist Insurers: Seek out insurers who specialise in providing cover for drivers with medical conditions. They might have a better understanding of your needs and offer competitive rates.

- Inform the DVLA: Make sure that your medical condition is properly reported to the DVLA. Failure to do so can result in fines and may invalidate your insurance.

- Regular Medical Check-Ups: Keep up with regular medical check-ups and follow your doctor’s advice. Demonstrating that you are managing your condition effectively can aid in negotiating better insurance rates.

Securing Suitable Insurance Cover

By being proactive and thoroughly exploring your options, you can still find appropriate car insurance despite having a medical condition that affects your driving. It’s about balancing the need for adequate cover with the unique aspects of your medical situation.

How much can you save on your car insurance?

What Health Conditions Need to Be Reported to the DVLA?

Mandatory Reporting of Certain Conditions

There are various health conditions that must be reported to the DVLA, as they could affect your ability to drive safely. It’s crucial to be aware of these conditions to ensure compliance with driving regulations.

Diabetes

If you are insulin-dependent or have had instances of severe hypoglycaemia, it’s mandatory to inform the DVLA.

Epilepsy

Those who have experienced seizures or are on medication for epilepsy need to notify the DVLA.

Sleep Apnoea

Conditions like obstructive sleep apnoea syndrome or other sleep disorders causing excessive sleepiness must be reported.

Heart Conditions

Inform the DVLA about any heart-related issues, including cardiomyopathy, heart failure, or if you have an implanted defibrillator.

Glaucoma

Glaucoma, particularly if it affects both eyes or is advanced in one eye, should be disclosed to the DVLA.

Strokes and Related Conditions

Any history of transient ischemic attacks, strokes, or similar conditions that could impair driving ability must be reported.

Visual Impairment

Significant visual impairments, including reduced visual acuity, visual field defects, or monocular vision, need to be communicated to the DVLA.

Physical Disabilities

Physical disabilities that affect driving capabilities or necessitate vehicle modifications should also be reported.

Compliance with DVLA Guidelines

This list isn’t exhaustive; other health conditions might also require reporting. Always refer to the DVLA’s guidelines on medical conditions and driving for complete information.

Failing to report a relevant health condition can result in fines and could invalidate your car insurance. It’s essential to ensure you’re fully compliant to maintain both your legal driving status and insurance validity.

How much can you save on your car insurance?

How Do I Notify the DVLA About My Medical Conditions?

Checking Your Condition

To determine whether your medical condition needs to be reported, you should first visit the government website. This website provides comprehensive information on which medical conditions require notification to the DVLA.

Finding and Submitting Forms

Once you’ve established that your condition must be reported, you can find the relevant forms on the same website. These forms are designed specifically for different types of medical conditions and provide a structured way to inform the DVLA about your health status.

How much can you save on your car insurance?

Do I Have to Tell My Insurer About My Medical Conditions?

Reporting to Your Insurer

Yes, it’s essential to inform your insurer as well as the DVLA about any medical conditions that could impose restrictions on your driving. This ensures that your insurance cover remains valid and accurately reflects your driving capabilities.

How much can you save on your car insurance?

Will Having a Licence Restriction Affect the Cost of My Car Insurance Policy?

Impact of Licence Restrictions on Insurance Cost

If you have a licence restriction due to a medical condition, it generally should not affect the cost of your car insurance policy.

Insurers are not allowed to refuse cover, increase premiums, or impose a higher excess fee solely based on your health condition.

This is only permissible if there is concrete evidence suggesting that your medical condition significantly increases your risk as a driver.

Importance of Informing Your Insurer

Despite this, it’s crucial to inform your insurer about any medical restrictions on your licence. This ensures that your insurance policy accurately reflects your circumstances and provides adequate cover in the event of an accident.

Being transparent about your medical condition helps maintain the validity of your insurance policy.

How much can you save on your car insurance?

The duration for which you’ve held your driving licence is indeed a significant factor in determining your car insurance premiums.

Generally, car insurance tends to be less costly for drivers who are considered experienced or older, having held their licence for an extended period.

Impact of Licence Duration on Costs

Statistics show that drivers who have had their licence for at least five years typically pay around £600 less annually for their car insurance policy.

This reduced cost reflects insurers’ perception of experienced drivers as being less risky compared to newer drivers.

How much can you save on your car insurance?

Compare Car Insurance with Comparoo

Finding the Right Insurance on Comparoo

For driving legally on UK roads, having valid car insurance is a necessity, irrespective of the type of licence you hold.

Comparoo offers a streamlined platform to compare car insurance policies, helping you find the ideal cover for your specific needs.

By entering details about yourself, your vehicle, and your driving history, Comparoo can generate a list of quotes tailored to your requirements.

Comparing Policy Features

When using Comparoo, you can compare policies based on annual and monthly costs, the excess fee required, and the extent of cover provided. This comprehensive comparison allows you to evaluate different options effectively.

Finalising Your Insurance Purchase

Once you’ve selected the most suitable policy, you can proceed to the insurer’s website directly from Comparoo to complete the purchase process.

Considering More Than Just Price

While searching for car insurance, it’s crucial to remember that the cheapest option isn’t always the best.

It’s important to find a policy that offers adequate cover for your needs at a reasonable price. This approach helps you avoid the pitfalls of being over-insured or under-insured.