Compare cheap car insurance

✔ Compare cheap car insurance quotes

✔ Over 110 insurance providers

✔ Get a quote in minutes

✔ Save up to £504*

Once you’ve reached the significant milestone of 70 years, it’s important to note that your driving licence will expire automatically. However, if you wish to continue enjoying the freedom of driving, renewing your licence becomes a necessary step.

- How to renew your driving licence online

- How to renew your driving licence by post

- What documents do I need to include with my renewal application?

- What proof of identity documents will the DVLA accept?

- Can I drive while the DVLA has my driving licence?

- What if I have a medical condition?

- How good does my eyesight need to be to drive?

- How do I get a blue badge for disabled parking?

- Can I find cheaper car insurance after the age of 70?

- Frequently asked questions

Nonetheless, before embarking on this process, it is crucial to take into account several factors, with the foremost one being your personal assurance in maintaining safe driving practices.

In this comprehensive guide, we aim to provide you with all the essential information you need to navigate the process of renewing your driving licence at the age of 70.

How to renew your driving licence online

If you’re looking for a fast and hassle-free way to renew your driving licence, the Government website provides a convenient online solution. To begin, you’ll need to register for access to the online service, which allows you to complete the renewal process digitally.

Once you’ve successfully registered, you can proceed to fill out the online form and submit the required documents electronically. The entire process is designed to be user-friendly and straightforward.

It’s worth noting that renewing your driving licence online has become increasingly popular among individuals aged 70 and above. In fact, an impressive six out of 10 over-70s now opt for the online renewal method, highlighting its efficiency and ease of use.

By embracing this digital avenue, you can save valuable time and effort, allowing you to swiftly resume your driving privileges with minimal inconvenience.

How much can you save on your car insurance?

How to renew your driving licence by post

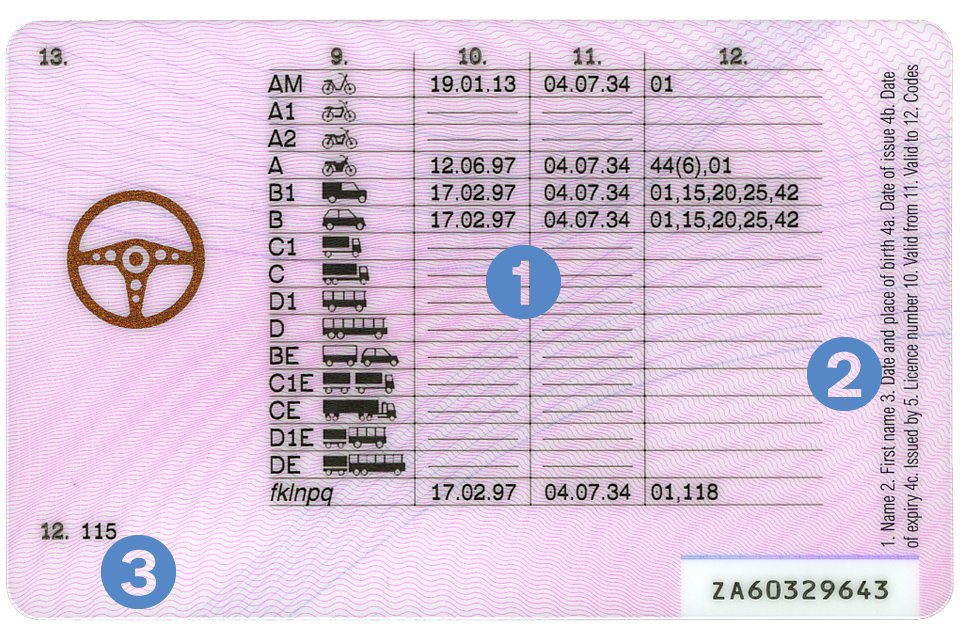

When it comes to renewing your driving licence by post, the DVLA (Driver and Vehicle Licensing Agency) ensures a seamless experience for individuals approaching their 70th birthday. Around 90 days prior to this significant milestone, you should expect to receive a licence renewal application directly from the DVLA.

This essential form, commonly known as a D46P (or a DL1R if you reside in Northern Ireland), will be included in the mailing. Renewing your licence by post is indeed a slower process compared to online renewal, typically taking approximately three to four weeks. However, it’s important to note that the duration may extend if your medical or personal details require additional verification.

While the timeline might be longer for postal renewal, rest assured that the DVLA is committed to meticulously reviewing your information to ensure accuracy and compliance. By adhering to the postal renewal process, you can confidently proceed with renewing your driving licence, allowing you to continue enjoying the privileges of driving with peace of mind.

How much can you save on your car insurance?

What documents do I need to include with my renewal application?

To ensure a smooth renewal process, it’s essential to provide the necessary documents along with your application. If you choose to renew your driving licence online for the first time, there are a few key items you’ll need to gather.

These include a valid email address, a comprehensive list of your addresses for the past three years, and, if available, your National Insurance number. Furthermore, if you wish to update the photo on your licence, you’ll need to provide a valid UK passport number as well.

If you possess a photocard licence, the procedure slightly differs. You will be required to send your completed form, along with your current licence and a passport-style photograph, directly to the DVLA. Ensuring that these documents are enclosed will facilitate a seamless renewal process for you.

On the other hand, if you hold a paper licence, the DVLA has specific requirements. Alongside your completed D46P form, you must include a passport-style photograph and an original document that serves as proof of your identity.

It’s crucial to note that the DVLA strictly accepts original documents and does not accept copies, ensuring the authenticity and security of your application.

By meticulously preparing and including the requisite documents, you can confidently submit your renewal application to the DVLA, knowing that you have fulfilled all the necessary requirements for a successful renewal.

How much can you save on your car insurance?

What proof of identity documents will the DVLA accept?

When submitting your driving licence renewal application, it is imperative to include valid proof of your identity. The DVLA accepts several types of documents that serve as acceptable proof. Here are some examples:

-

Passport: Your valid passport is a widely recognised and accepted form of identification. Including a photocopy or providing the passport number will suffice.

-

Official State Pension Eligibility Letter: If you’re eligible for the State Pension, an official letter confirming your eligibility can be presented as proof of identity.

-

Biometric Residence Permit (BRP): For foreign nationals residing in the UK, a biometric residence permit, also known as an identity card, serves as a suitable document for verifying your identity.

These are just a few examples of the documents the DVLA accepts for proof of identity. It’s important to carefully review the specific requirements outlined by the DVLA and ensure that the document you provide meets their standards.

By including the appropriate proof of identity document with your renewal application, you can establish your identity with confidence, facilitating a smooth and successful renewal process.

How much can you save on your car insurance?

Can I drive while the DVLA has my driving licence?

In most cases, if you have sent your driving licence to the DVLA for renewal, you can continue driving as usual. However, it’s crucial to be aware of certain exceptions that may require you to cease driving temporarily. Here are a few situations where you should refrain from driving:

-

Your GP’s Assessment: If your general practitioner (GP) determines that you are not medically fit to drive, it is imperative to adhere to their advice and discontinue driving until you are deemed fit to do so.

-

Self-Assessment of Fitness: If you personally feel that you are not medically fit to drive due to a change in your health condition, it is vital to prioritize safety and refrain from driving until you are confident in your ability to operate a vehicle safely.

-

Previous Medical Grounds: If your most recent driving licence was refused or revoked on medical grounds, it is essential to abide by the DVLA’s decision and refrain from driving until you have successfully resolved the medical issue or received clearance from the appropriate authorities.

-

Invalid Licence During Renewal: If you did not possess a valid driving licence at the time of applying for your renewal, it is crucial to refrain from driving until your renewed licence is in your possession.

-

Disqualification from Driving: If you have been legally disqualified from driving, whether due to previous offences or legal proceedings, it is strictly prohibited to continue driving until the disqualification period has ended or specific conditions have been met.

While the DVLA processes your driving licence renewal, it is vital to prioritise safety and comply with any restrictions or limitations outlined by the DVLA, medical professionals, or legal authorities. By doing so, you contribute to the well-being of yourself and others on the road.

How much can you save on your car insurance?

What if I have a medical condition?

It is a legal requirement to inform the DVLA if you have certain medical conditions or disabilities that may affect your ability to drive. This obligation applies even if you have not yet reached the age of 70, or if you are in between renewal periods when you are diagnosed with a medical condition.

Failure to disclose a medical condition that impacts your driving can lead to a fine of up to £1,000. Moreover, if you are involved in an accident resulting from an undisclosed medical condition, you may face prosecution.

The complete list of medical conditions that require notification can be found on the Government website. Some examples of these conditions include:

- Dementia

- Diabetes requiring insulin treatment

- Parkinson’s disease

- Epilepsy

- Neurological disorders like multiple sclerosis

- Conditions affecting both eyes or resulting in total loss of sight in one eye, strokes of a certain severity, and cancers of a certain severity.

It is important to note that the DVLA does not automatically prohibit driving if you have one of these conditions. Instead, they may request a medical examination to assess the severity of the condition. Based on the assessment, they may issue a short-term, one-year licence or require modifications to your vehicle to ensure safe driving.

Additionally, the DVLA may want to evaluate your driving skills. You can opt to take a driving assessment course at a local mobility centre or consider enrolling in a RoSPA Experienced Driver Assessment course. These courses can provide valuable insights and reassurance regarding your driving abilities, even if you don’t have a medical condition.

If you are diagnosed with a medical condition, it is crucial to inform your car insurance provider immediately. Failing to disclose a medical condition that could have contributed to an accident can invalidate your car insurance policy and may result in prosecution.

Prioritising safety and adhering to legal obligations regarding medical conditions and driving is essential. By responsibly managing your medical conditions, notifying the DVLA as required, and maintaining open communication with your car insurance provider, you contribute to the safety of yourself and others on the road.

How much can you save on your car insurance?

How good does my eyesight need to be to drive?

To legally drive in the UK, it is essential to fulfilling specific eyesight criteria, regardless of your age. However, it is permissible to wear corrective glasses or contact lenses to meet these requirements.

To qualify for driving legally, you must be able to:

-

Read a Modern Number Plate: From a distance of 20 metres, you should be able to read a number plate manufactured after September 2001. This test ensures that you have adequate visual acuity to identify and recognise objects on the road.

-

Attain Visual Acuity: Your visual acuity must meet at least decimal 0.5 (6/12) on the Snellen scale. This scale employs an eye chart to measure the clarity of your vision, enabling you to discern details with sufficient accuracy.

-

Maintain an Adequate Field of Vision: Having an adequate field of vision is crucial for driving safely. This means that your peripheral vision and ability to see objects within your range are not significantly impaired.

For a more comprehensive understanding of these requirements and to undergo the necessary tests, it is advisable to consult with your optician. They can provide you with detailed information regarding your eyesight and conduct the tests to determine if you meet the criteria.

It’s important to note that these requirements primarily apply to car drivers. If you operate a lorry or bus, there are stricter regulations in place to ensure enhanced visual capabilities for larger vehicles.

By ensuring that your eyesight meets the necessary standards, you contribute to the overall safety of yourself and other road users. Regular visits to your optician, wearing corrective lenses if needed, and adhering to the established requirements ensure that your vision is optimal for driving purposes.

How much can you save on your car insurance?

How do I get a blue badge for disabled parking?

As per the United Nations, over 46% of individuals over the age of 60 experience disabilities. However, having a disability does not necessarily mean you have to give up driving. In fact, it may qualify you for a Blue Badge, which can provide valuable parking benefits. With a Blue Badge, you can enjoy:

-

Free On-Street Parking and Pay-and-Display: The Blue Badge allows you to park free of charge in designated on-street parking areas and at pay-and-display locations, granting you convenient access to various destinations.

-

Parking on Single or Double Yellow Lines: With a Blue Badge, you are permitted to park on single or double yellow lines for a maximum of three hours, providing you with additional flexibility when it comes to parking options.

-

Accessible Parking at Supermarkets and Shopping Malls: Blue Badge holders are entitled to accessible parking spaces at supermarkets and shopping malls, ensuring greater ease and convenience while running errands or enjoying leisure activities.

It is important to note that each borough may have different criteria for issuing Blue Badges. To initiate the application process, it is necessary to contact your local council.

Your local council’s website should contain comprehensive information regarding the application procedure, eligibility criteria, and any additional requirements specific to your area.

By reaching out to your local council and following the application guidelines provided on their website, you can obtain the necessary information to apply for a Blue Badge. This will enable you to take advantage of the accessible parking privileges and enhance your mobility and independence.

How much can you save on your car insurance?

Can I find cheaper car insurance after the age of 70?

After successfully renewing your driving licence, it’s worth considering the possibility of securing more affordable car insurance as an older driver. Taking the time to explore various options can potentially lead to obtaining more competitive quotes tailored to your needs.

To facilitate this process, we recommend using our user-friendly price comparison service at Comparoo. By using this tool, you can conveniently compare different car insurance policies and providers, enabling you to identify potential cost savings while ensuring you find the right cover that suits your requirements.

Our price comparison service simplifies the task of navigating through the diverse car insurance offerings available in the market. By entering relevant details and preferences, you can receive personalised quotes from multiple insurers, allowing you to make an informed decision based on factors such as cover, premiums, and additional benefits.

Through this streamlined approach, you can potentially discover car insurance policies that offer better value for money, thereby maximising your savings as a driver over the age of 70. Embracing this opportunity to explore cost-effective options is an effective way to ensure you have the necessary cover while optimising your financial resources.

Take advantage of Comparoo’s price comparison service today and embark on a journey towards securing more affordable car insurance that suits your unique needs and preferences.

Frequently asked questions

When it comes to renewing your driving licence, the process is refreshingly wallet-friendly. The Driver and Vehicle Licensing Agency (DVLA) does not charge any fees for renewing your driving licence, making it a cost-free endeavour.

When renewing your driving licence online, you can expect a relatively quick turnaround time. Typically, it takes approximately one week for your renewed licence to arrive.

Once you surpass the age of 70, it is important to be aware that your driving licence requires renewal every three years. This renewal cycle ensures that your licence remains up-to-date and reflective of your continued eligibility to drive safely on the roads.

In the unfortunate event that your driving licence is lost, damaged, or stolen you’ll need to tell the police.

The process of getting a replacement is straightforward and can be conveniently done online. However, it’s important to note that there is a fee of £20 associated with this service.

The cost of getting a Blue Badge varies depending on the region in the UK. In England, acquiring a Blue Badge incurs a fee of £20, while in Scotland, the cost is £10. However, in Wales, the application process for a Blue Badge is free of charge.

Renewing your driving licence at the age of 70 does not require you to undergo another driving test, provided there are no medical conditions affecting your driving abilities. The renewal process primarily focuses on updating the validity of your licence and ensuring compliance with necessary regulations.

However, if you are interested in having your driving skills reviewed and receiving valuable tips for safer driving as an older motorist, you have the option to participate in an advanced driving course specifically designed for individuals in your age group.

As you approach the age of 70, it’s possible that you may notice a slight increase in the cost of your car insurance compared to your previous rates in your 60s.

However, the good news is that by exploring your options and conducting thorough research, you should be able to find favourable deals on car insurance tailored specifically for individuals over 70.