Compare cheap car insurance

✔ Compare cheap car insurance quotes

✔ Over 110 insurance providers

✔ Get a quote in minutes

✔ Save up to £504*

Driving without a valid MOT is against the law and can result in significant fines if caught. But what impact does it have on your car insurance?

- Is my car insurance still valid if my MOT expires?

- Can you insure your car without an MOT?

- Can I claim on my car insurance if I don’t have an MOT?

- What if I’m involved in an accident with another driver without a valid MOT?

- How to check if your car has a valid MOT?

- What are the consequences of driving without a valid MOT?

- Are there any circumstances when you are exempt from needing an MOT?

- Is it legal to drive my car without insurance to get its MOT?

Our guide explains why an expired MOT certificate could potentially invalidate your insurance.

Is my car insurance still valid if my MOT expires?

The short answer is that it largely depends on your specific insurance policy. In the majority of cases, having a valid MOT certificate is a standard condition of car insurance cover.

Consequently, if you drive without a valid MOT, your insurance could become invalid, leading to a double violation of the law: driving without a proper MOT and driving without valid insurance.

However, if your car insurance policy does not explicitly state that having a valid MOT is a condition of cover (although this is uncommon), the situation becomes a bit more complicated. Car insurance typically requires your vehicle to be roadworthy, meaning it should be in a safe and fit condition for driving.

While an MOT certifies your car’s roadworthiness at the time of testing, various factors may change afterwards. For instance, your tyres might have been legal during the MOT but could have worn down to an unsafe level afterwards.

Similarly, other components like headlights may fail unexpectedly post-MOT. On the flip side, not having a valid MOT doesn’t necessarily imply that your car is not roadworthy; you may have merely forgotten to take it for the test.

Ultimately, the validity of your insurance hinges on whether your car was roadworthy when you drove it. To be on the safe side and remain compliant with the law, it is important to have a valid MOT certificate for your vehicle.

This way, you ensure your car’s safety and legal driving status while also abiding by the requirements of your car insurance policy.

Check to see if your car has a valid MOT certificate

How much can you save on your car insurance?

Can you insure your car without an MOT?

It’s highly unlikely. Car insurance providers typically require a valid MOT certificate before insuring a car. The reason behind this requirement is that your vehicle must be in a roadworthy condition for the insurance cover to be valid, and an MOT serves as proof of its roadworthiness.

If your car’s current MOT has expired, and your insurance is due for renewal, it’s essential to communicate with your insurance company. In some cases, they might offer to renew your policy, provided you get your car MOT tested and get a valid certificate.

Without a valid MOT, the law only permits you to drive your car to a pre-arranged MOT appointment. Any other use on public roads would be illegal and can result in penalties. Additionally, driving or parking on public roads without valid insurance is also against the law, with serious consequences.

Ensuring that your car has a valid MOT is not only essential for abiding by legal requirements but also for your safety and the safety of others on the road. An MOT test thoroughly examines your vehicle’s key components to ensure they meet safety and environmental standards.

Keeping your car roadworthy and up to date with its MOT not only facilitates car insurance but also guarantees that you are driving a safe and compliant vehicle.

Therefore, it is essential to schedule your MOT test promptly and maintain compliance with both MOT and insurance requirements to drive legally and securely on the roads.

How much can you save on your car insurance?

Can I claim on my car insurance if I don’t have an MOT?

The possibility of making a claim without an MOT depends on your specific insurance provider and policy conditions. In many cases, having a valid MOT certificate is a crucial requirement for car insurance cover.

If your policy mandates a valid MOT, driving without one will invalidate your insurance, leaving you unable to make a claim.

Consequently, if you find yourself in an accident or need repairs for your car and you don’t have a valid MOT, you will be personally responsible for covering the repair costs.

Additionally, you will be liable for any damage caused to other vehicles in the incident. Moreover, being pulled over by the police or involved in an accident without valid insurance and an expired MOT can lead to legal penalties.

In the rare scenario where having an MOT is not a condition of your insurance policy, the claims process can become more complicated. The insurance assessor handling your claim would need to conduct a thorough investigation to determine if your car was roadworthy at the time of the claim. This could prolong the claims process, making it more time-consuming and intricate.

Even if your insurance provider determines that your car was indeed roadworthy and your insurance remains valid, you might face reduced compensation if your car is written off or stolen. An expired MOT can automatically reduce your car’s value, leading to lower payouts in such situations.

Having a valid MOT is not only essential for abiding by legal requirements but also for protecting yourself financially in the event of an accident or unforeseen circumstances.

Regularly conducting MOT tests ensures that your car meets safety and environmental standards, guaranteeing a safer driving experience and a smoother insurance claims process if the need arises.

It is essential to prioritise keeping your car roadworthy, validly insured, and up to date with its MOT for your safety and financial security on the roads.

How much can you save on your car insurance?

What if I’m involved in an accident with another driver without a valid MOT?

If you find yourself in an accident where the other driver is at fault and their car doesn’t have a valid MOT, there are still potential avenues for your insurance provider to claim damages through the other driver’s car insurance.

While it might complicate matters if their policy is invalidated due to the lack of an MOT, their insurance provider should not refuse to pay out for third-party damages in such a scenario.

In case the other driver’s insurance provider declines the claim, the responsibility to cover the damages falls upon the driver who caused the accident.

Dealing with an uninsured or underinsured driver can be challenging, but your insurance company can guide you through the process and advise you on how to proceed.

It’s crucial to report the accident to your insurance provider promptly and provide them with all the necessary details and evidence. They will assess the situation, handle the claim process, and work towards getting compensation for the damages from the other driver’s insurance, if possible.

In case the other driver is uninsured, your own insurance policy’s uninsured motorist cover may come into play to cover your damages, subject to the policy terms and conditions.

However, it’s essential to understand your insurance cover and know what options are available to you in such unfortunate situations.

Handling accidents involving drivers without a valid MOT or proper insurance can be complex, but staying informed and seeking assistance from your insurance company will help ensure you navigate through the process more smoothly.

Always be proactive in reporting accidents and gathering evidence to support your claim, and consult your insurance provider for guidance on the best course of action in such circumstances.

How much can you save on your car insurance?

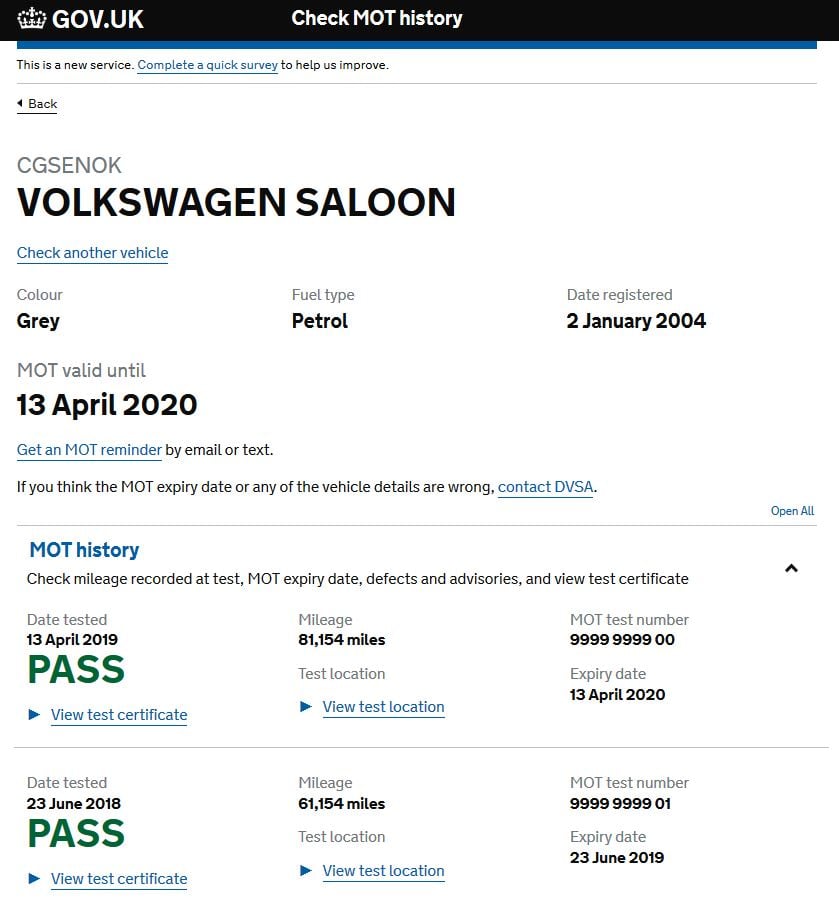

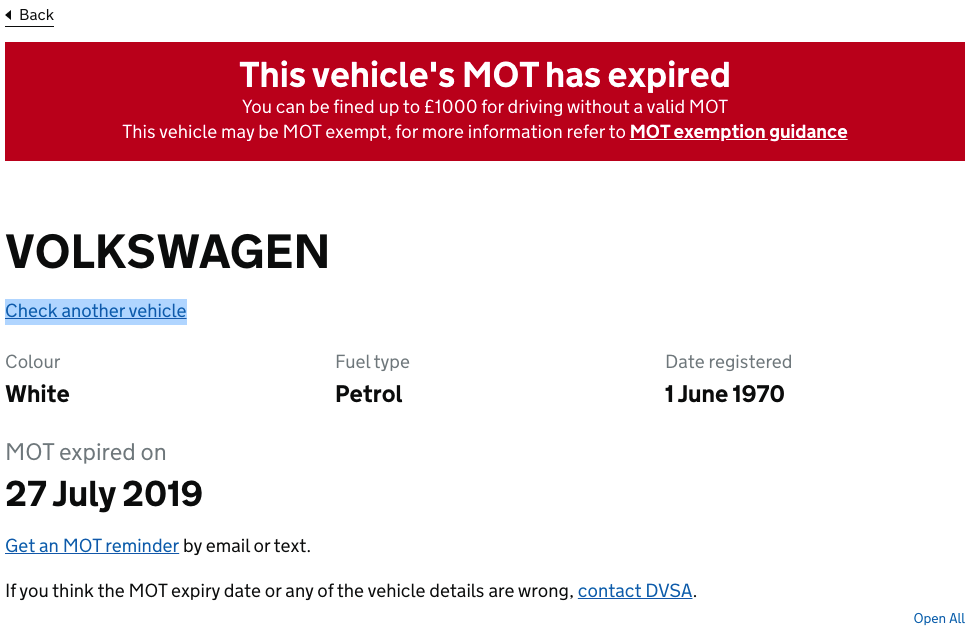

How to check if your car has a valid MOT?

It’s easy to check the MOT status of your car by visiting the official gov.uk website. Simply enter your vehicle registration number, and the website will provide you with the current validity status of your MOT.

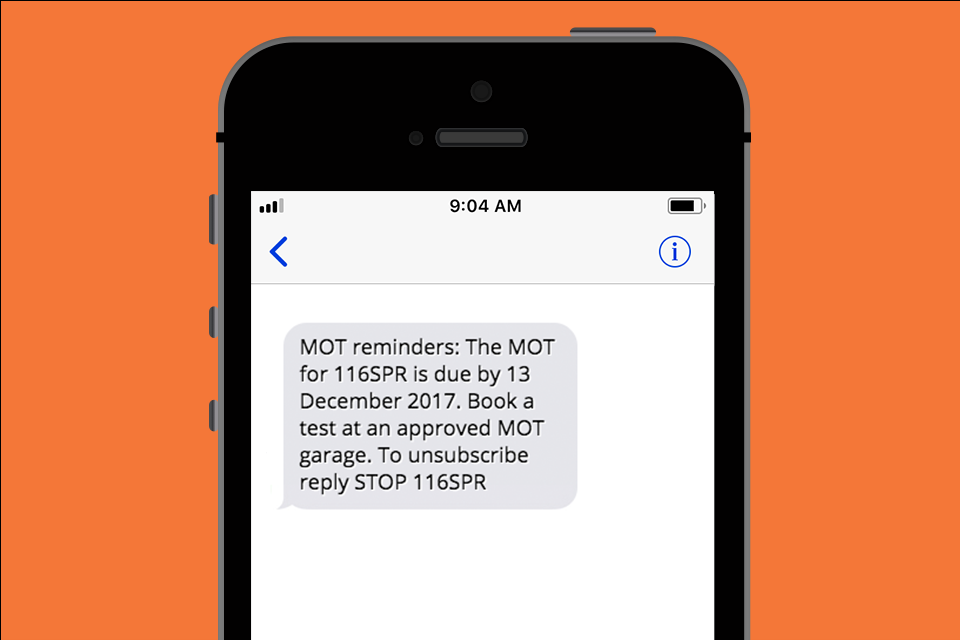

To stay prepared for future MOTs, you can request your local garage or MOT test centre to set up an MOT reminder for your next due date. This way, you’ll receive timely notifications to ensure your car is always up-to-date with its MOT, avoiding any potential legal issues and ensuring its roadworthiness.

Check MOTHow much can you save on your car insurance?

What are the consequences of driving without a valid MOT?

Driving a car without a current valid MOT is against the law and can lead to significant penalties. If caught by the police, you could face a fine of up to £1,000.

It’s essential not to underestimate the likelihood of being caught. Police vehicles and roadside cameras equipped with automatic number-plate recognition (ANPR) technology are widespread.

They can quickly check your car registration against the national database to determine if your vehicle lacks a valid MOT certificate or if road tax payment is overdue.

To avoid legal trouble and ensure compliance, always make sure your car has a valid MOT certificate. Regularly scheduling MOT tests not only keeps you on the right side of the law but also ensures your car meets safety and environmental standards, providing a safer driving experience for you and other road users.

How much can you save on your car insurance?

Are there any circumstances when you are exempt from needing an MOT?

Yes, there are specific situations where you can legally drive your car without an MOT:

-

If your car is less than three years old: If your vehicle is brand new and less than three years old, it is exempt from requiring an MOT. However, do keep in mind that this concession might not apply to all car models, so it’s essential to verify with the relevant authorities for specific details.

-

When driving to a pre-booked MOT test: You can drive your car without a valid MOT certificate if you are on your way to a pre-arranged MOT test. However, you must be able to provide proof of the booking if you are stopped by the police or any other relevant authorities during your journey.

It’s essential to understand the exemptions and adhere to the guidelines to ensure compliance with the law. Regularly scheduling MOT tests for your car is vital for maintaining its roadworthiness and safety.

Even if your vehicle is exempt from an MOT due to its age or for a pre-booked test, it’s crucial to keep up with regular maintenance and ensure your car is in good working condition to ensure a safe driving experience for yourself and others on the road.

Remember to stay informed about any changes to the MOT exemption rules and always be proactive in fulfilling your responsibilities as a car owner.

How much can you save on your car insurance?

Is it legal to drive my car without insurance to get its MOT?

No, driving your car without valid insurance, even for a short trip to a pre-booked MOT appointment, is illegal and can lead to severe consequences.

If caught driving without insurance, you could face a fixed penalty of £300 and receive six penalty points on your driving licence.

In the worst-case scenario:

- Your car may be seized

- You could be subjected to an unlimited fine

- Face disqualification from driving

Clearly, the risks are not worth taking.

According to continuous insurance enforcement rules, your car must be insured at all times, even when it’s not in use. The only exception to this rule is if you have applied for a Statutory Off Road Notification (SORN), officially declaring your car off the road and parking it on private property. In this case, you won’t require valid insurance, an MOT certificate, or road tax.

However, as soon as you wish to remove the SORN and drive your car again, you will need to get road tax, renew your MOT certificate if it has expired, and have valid insurance cover in place.

If your annual car insurance policy has expired, and you’re unsure whether your car will pass its MOT, consider getting temporary car insurance. This can provide you with cover for a specific period while you assess your car’s roadworthiness and decide on your long-term insurance options.

It is crucial to prioritise road safety and compliance with legal requirements. Maintaining valid car insurance, along with a current MOT certificate, is not only essential for legal reasons but also for protecting yourself and others on the road.

Always ensure that your car meets the necessary roadworthy standards, renew your MOT on time, and keep your insurance cover up-to-date to drive legally and responsibly.